Page 189 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 189

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - SAP

Sappi Ltd. Sasol Ltd.

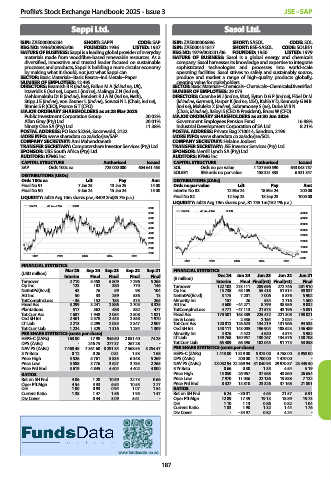

ISIN: ZAE000006284 SHORT: SAPPI CODE: SAP ISIN: ZAE000006896 SHORT: SASOL CODE: SOL

REG NO: 1936/008963/06 FOUNDED: 1936 LISTED: 1937 ISIN: ZAE000151817 SHORT: BEE-SASOL CODE: SOLBE1

NATURE OF BUSINESS: Sappi is a leading global provider of everyday REG NO: 1979/003231/06 FOUNDED: 1950 LISTED: 1979

materials made from woodfibre-based renewable resources. As a NATURE OF BUSINESS: Sasol is a global energy and chemicals

diversified, innovative and trusted leader focused on sustainable company. Sasol harnesses its knowledge and expertise to integrate

processes and products, Sappi is building a more circular economy sophisticated technologies and processes into world-scale

by making what it should, not just what Sappi can. operating facilities. Sasol strives to safely and sustainably source,

SECTOR: Basic Materials--Basic Resrcs--Ind Metals--Paper produce and market a range of high-quality products globally,

NUMBER OF EMPLOYEES: 12 495 creating value for stakeholders.

DIRECTORS: Beamish B R (ind ne), Fallon M A (ld ind ne, UK), SECTOR: Basic Materials--Chemicals--Chemicals--Chemicals:Diversified

Istavridis E (ind ne), Lopez J (ind ne), Malinga Z N (ind ne), NUMBER OF EMPLOYEES: 29 073

Mehlomakulu Dr B (ind ne), Renders R J A M (ind ne, Neth), DIRECTORS: Cuambe M J (ind ne, Moz), Eyton D G P (ind ne), Flöel Dr M

Stipp J E (ind ne), von Zeuner L (ind ne), Sowazi N L (Chair, ind ne), (ld ind ne, German), Harper K (ind ne, USA), Kahla V D, Kennealy G M B

Binnie S R (CEO), Pearce G T (CFO) (ind ne), Maluleke X (ind ne), Subramoney S (ne), Dube M B N

MAJOR ORDINARY SHAREHOLDERS as at 28 Mar 2025 (Chair, ld ind ne), Baloyi S (CEO & President), Bruns W (CFO)

Public Investment Corporation Group 20.02% MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

Allan Gray (Pty) Ltd. 20.01% Government Employees Pension Fund 16.98%

Ninety One SA (Pty) Ltd. 11.38% Industrial Development Corporation of SA Ltd. 8.21%

POSTAL ADDRESS: PO Box 52264, Saxonwold, 2132 POSTAL ADDRESS: Private Bag X10014, Sandton, 2196

MORE INFO: www.sharedata.co.za/sdo/jse/SAP MORE INFO: www.sharedata.co.za/sdo/jse/SOL

COMPANY SECRETARY: Ami Mahendranath COMPANY SECRETARY: Helaine Joubert

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: UBS South Africa (Pty) Ltd. SPONSOR: Merrill Lynch SA (Pty) Ltd.

AUDITORS: KPMG Inc. AUDITORS: KPMG Inc.

CAPITAL STRUCTURE Authorised Issued CAPITAL STRUCTURE Authorised Issued

SAP Ords 100c ea 725 000 000 604 641 463 SOL Ords no par value 1 127 690 590 643 043 757

DISTRIBUTIONS [USDc] SOLBE1 BEE ords no par value 158 331 335 6 331 347

Ords 100c ea Ldt Pay Amt DISTRIBUTIONS [ZARc]

Final No 91 7 Jan 25 13 Jan 25 14.00 Ords no par value Ldt Pay Amt

Final No 90 9 Jan 24 15 Jan 24 15.00 Interim No 83 12 Mar 24 18 Mar 24 200.00

LIQUIDITY: Jul25 Avg 10m shares p.w., R409.2m(85.7% p.a.) Final No 82 12 Sep 23 18 Sep 23 1000.00

LIQUIDITY: Jul25 Avg 19m shares p.w., R1 745.1m(152.1% p.a.)

SAPPI 40 Week MA IDMS

6500

SASOL 40 Week MA CHES

6000 45000

5500 40000

5000

35000

4500

30000

4000

25000

3500

20000

3000

15000

2500

2000 10000

2021 2022 2023 2024 2025

5000

2021 2022 2023 2024 2025

FINANCIAL STATISTICS

Mar 25 Sep 24 Sep 23 Sep 22 Sep 21 FINANCIAL STATISTICS

(USD million)

Interim Final Final Final Final (R million) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

Turnover 2 710 5 458 5 809 7 296 5 265 Interim Final Final(rst) Final(rst) Final

Op Inc 123 182 380 770 146 Turnover 122 102 275 111 289 696 272 746 201 910

NetIntPd(Rcvd) 43 76 59 98 104 Op Inc 15 738 48 109 55 418 51 514 39 837

Att Inc 50 33 259 536 13 NetIntPd(Rcvd) 3 175 7 201 7 006 5 876 5 902

TotCompIncLoss - 36 152 185 375 265 Minority Int 157 26 534 2 716 1 500

Fixed Ass 3 299 3 241 2 886 2 705 3 325 Att Inc 4 600 - 44 271 8 799 38 956 9 032

Plantations 517 562 488 382 477 TotCompIncLoss 4 771 - 47 113 21 573 43 196 - 5 091

Tot Curr Ass 1 687 1 948 2 054 2 508 1 921 Fixed Ass 170 501 163 589 225 472 221 308 198 021

Ord SH Int 2 461 2 578 2 445 2 358 1 970 Inv & Loans - 2 536 2 164 2 024 -

LT Liab 2 213 2 299 2 035 2 347 2 907 Tot Curr Ass 120 012 126 623 134 219 131 966 94 533

Tot Curr Liab 1 224 1 329 1 316 1 284 1 309 Ord SH Int 148 111 143 005 196 904 188 623 146 489

PER SHARE STATISTICS (cents per share) Minority Int 4 376 4 422 4 620 4 574 5 982

HEPS-C (ZARc) 163.80 17.98 946.50 2 051.40 74.25 LT Liab 149 768 150 957 130 267 134 576 150 708

DPS (ZARc) - 246.75 277.37 267.28 - Tot Curr Liab 65 409 66 596 102 045 91 773 53 858

NAV PS (ZARc) 7 468.45 7 361.60 8 291.34 7 568.55 5 254.47 PER SHARE STATISTICS (cents per share)

3 Yr Beta 0.12 0.26 0.81 1.53 1.68 HEPS-C (ZARc) 1 413.00 1 819.00 5 375.00 4 758.00 3 953.00

Price High 5 526 5 761 5 835 6 348 5 269 DPS (ZARc) - 200.00 1 700.00 1 470.00 -

Price Low 3 588 3 776 3 627 3 785 2 265 NAV PS (ZARc) 23 032.94 22 269.94 31 040.95 29 970.87 23 449.50

Price Prd End 3 619 4 845 4 404 4 402 4 000 3 Yr Beta 0.66 0.30 1.35 4.54 5.19

RATIOS Price High 15 050 26 967 37 668 43 860 26 654

Ret on SH Fnd 4.06 1.28 10.59 22.73 0.66 Price Low 7 970 11 036 22 136 19 588 7 122

Oper Pft Mgn 4.54 3.33 6.54 10.55 2.77 Price Prd End 8 327 13 810 23 326 37 168 21 801

D:E 1.00 0.93 0.94 1.07 1.54 RATIOS

Current Ratio 1.38 1.47 1.56 1.95 1.47 Ret on SH Fnd 6.24 - 30.01 4.63 21.57 6.91

Div Cover - 0.44 3.09 5.61 - Oper Pft Mgn 12.89 17.49 19.13 18.89 19.73

D:E 1.10 1.13 0.86 0.82 1.04

Current Ratio 1.83 1.90 1.32 1.44 1.76

Div Cover - - 34.97 0.82 4.24 -

www.fundsdata.co.za

187