Page 194 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 194

JSE - SIR Profile’s Stock Exchange Handbook: 2025 - Issue 3

Sirius Real Estate Ltd. South32 Ltd.

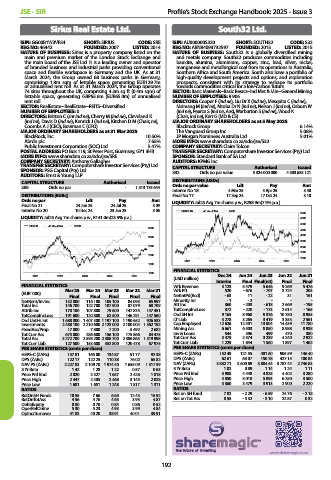

ISIN: GG00B1W3VF54 SHORT: SIRIUS CODE: SRE ISIN: AU000000S320 SHORT: SOUTH32 CODE: S32

REG NO: 46442 FOUNDED: 2007 LISTED: 2014 REG NO: ABN84093732597 FOUNDED: 2015 LISTED: 2015

NATURE OF BUSINESS: Sirius is a property company listed on the NATURE OF BUSINESS: South32 is a globally diversified mining

main and premium market of the London Stock Exchange and and metals company. South32 produces commodities including

the main board of the JSE Ltd. It is a leading owner and operator bauxite, alumina, aluminium, copper, zinc, lead, silver, nickel,

of branded business and industrial parks providing conventional manganese and metallurgical coal from its operations in Australia,

space and flexible workspace in Germany and the UK. As at 31 Southern Africa and South America. South also have a portfolio of

March 2024, the Group owned 68 business parks in Germany, high-quality development projects and options, and exploration

comprising 1.8m sqm of lettable space generating EUR129.7m prospects, consistent with its strategy to reshape its portfolio

of annualised rent roll. As at 31 March 2024, the Group operates towards commodities critical for a low-carbon future.

74 sites throughout the UK, comprising 4.3m sq ft (0.4m sqm) of SECTOR: Basic Materials--Basic Resrcs--Ind Met & Min--General Mining

lettable space, generating GBP55.6m (EUR65.0m) of annualised NUMBER OF EMPLOYEES: 9 906

rent roll. DIRECTORS: Cooper F (ind ne), Liu Dr X (ind ne), Mesquita C (ind ne),

SECTOR: RealEstate--RealEstate--REITS--Diversified Msimang M (ind ne), Mtoba Dr N (ind ne), Nelson J (ind ne), Osborn W

NUMBER OF EMPLOYEES: 0 (ind ne), Pearce S (ind ne, Aus), Warburton S (ind ne), Wood K

DIRECTORS: Britton C (snr ind ne), Cherry M (ind ne), Cleveland K (Chair, ind ne), Kerr G (MD & CE)

(ind ne), Davis D (ind ne), Kenrick J (ind ne), Kitchen D M (Chair, ne), MAJOR ORDINARY SHAREHOLDERS as at 5 May 2025

Coombs A J (CEO), Bowman C (CFO) Blackrock Group 6.14%

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2025 The Vanguard Group Inc. 5.08%

BlackRock, Inc. 10.50% JP Morgan Nominees Australia Ltd. 5.01%

Abrdn plc 7.65% MORE INFO: www.sharedata.co.za/sdo/jse/S32

Public Investment Corporation (SOC) Ltd. 5.47% COMPANY SECRETARY: Claire Tolcon

POSTAL ADDRESS: PO Box 119, St Peter Port, Guernsey, GY1 3HB TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/SRE SPONSOR: Standard Bank of SA Ltd.

COMPANY SECRETARY: Anthony Gallagher AUDITORS: KPMG Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE Authorised Issued

SPONSOR: PSG Capital (Pty) Ltd. S32 Ords no par value 5 324 000 000 4 503 635 121

AUDITORS: Ernst & Young LLP

CAPITAL STRUCTURE Authorised Issued DISTRIBUTIONS [USDc]

Pay

Ldt

SRE Ords no par - 1 513 175 644 Ords no par value 4 Mar 25 3 Apr 25 Amt

3.40

Interim No 18

DISTRIBUTIONS [EURc] Final No 17 17 Sep 24 17 Oct 24 3.10

Ords no par Ldt Pay Amt LIQUIDITY: Jul25 Avg 7m shares p.w., R258.9m(7.9% p.a.)

Final No 21 24 Jun 25 24 Jul 25 3.09

Interim No 20 10 Dec 24 23 Jan 25 3.06 SOUTH32 40 Week MA INDM

6000

LIQUIDITY: Jul25 Avg 7m shares p.w., R141.0m(23.5% p.a.)

5500

5000

SIRIUS 40 Week MA REDS

3500

4500

3000 4000

3500

2500

3000

2500

2000

2000

2021 2022 2023 2024 2025

1500

FINANCIAL STATISTICS

1000

2021 2022 2023 2024 2025 Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

(USD million) Interim Final Final(rst) Final Final

FINANCIAL STATISTICS Wrk Revenue 3 123 5 479 5 646 9 269 5 476

Mar 25 Mar 24 Mar 23 Mar 22 Mar 21 Wrk Pft 520 - 676 - 707 3 724 203

(EUR ’000)

Final Final Final Final Final NetIntPd(Rcd) - 63 11 - 22 31 161

NetRent/InvInc 132 800 116 100 105 100 84 093 65 997 Minority Int - 1 - 2 - - -

Total Inc 146 700 122 700 107 900 87 079 68 709 Att Inc 360 - 203 - 618 2 669 - 195

Attrib Inc 178 100 107 800 79 600 147 873 147 451 TotCompIncLoss 372 - 228 - 173 2 614 - 165

TotCompIncLoss 191 600 120 800 62 500 146 291 147 560 Ord SH Int 9 165 8 960 9 376 10 780 8 955

Ord UntHs Int 1 688 800 1 407 300 1 197 100 1 190 652 926 533 LT Liab 3 278 3 265 3 419 3 353 2 561

Investments 2 488 100 2 210 600 2 123 000 2 100 004 1 362 192 Cap Employed 12 626 12 401 13 004 14 439 11 780

FixedAss/Prop 17 800 7 800 7 200 5 492 2 682 Mining Ass 6 661 6 503 8 050 8 988 8 938

Tot Curr Ass 675 000 286 600 156 100 175 866 84 475 Inv & Loans 544 396 499 470 380

Total Ass 3 272 700 2 595 200 2 388 700 2 386 863 1 519 998 Tot Curr Ass 3 479 2 574 3 239 4 240 2 922

Tot Curr Liab 127 500 153 600 352 800 120 478 67 975 Tot Curr Liab 1 229 1 844 1 560 1 897 1 462

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 157.81 165.00 134.87 91.77 92.38 HEPS-C (ZARc) 152.49 121.55 401.60 905.59 146.40

DPS (ZARc) 122.17 122.25 110.38 76.02 65.82 DPS (ZARc) 62.61 63.07 150.78 427.15 100.84

NAV PS (ZARc) 2 227.83 2 109.70 1 974.40 1 655.09 1 317.59 NAV (ZARc) 3 832.71 3 600.69 3 884.44 3 787.44 2 746.83

3 Yr Beta 1.42 1.28 1.22 0.57 0.63 3 Yr Beta 1.02 0.89 1.14 1.24 1.11

Price Prd End 2 020 2 327 1 657 2 428 1 818 Price Prd End 3 988 4 448 4 825 4 402 3 280

Price High 2 447 2 405 2 468 3 145 2 028 Price High 4 850 5 018 5 893 6 250 3 500

Price Low 1 681 1 651 1 248 1 817 1 311 Price Low 3 360 3 479 3 913 2 900 2 220

RATIOS RATIOS

RetOnSH Funds 10.55 7.66 6.65 12.43 15.92 Ret on SH fund 7.82 - 2.29 - 6.59 24.76 - 2.18

RetOnTotAss 4.56 4.76 4.63 3.95 4.87 Ret on Tot Ass 8.55 - 5.32 - 3.10 22.87 0.32

Debt:Equity 0.80 0.70 0.84 0.86 0.52

OperRetOnInv 5.30 5.23 4.93 3.99 4.84

OpInc:Turnover 41.83 40.20 38.91 40.01 39.91

192