Page 68 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 68

JSE – 4SI Profile’s Stock Exchange Handbook: 2025 – Issue 1

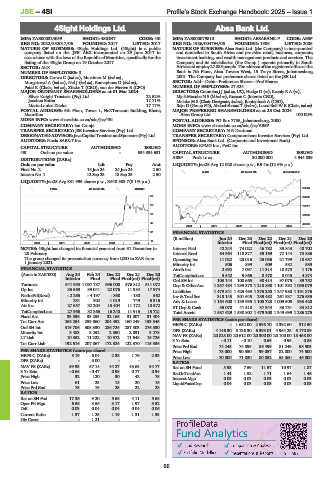

4Sight Holdings Ltd. Absa Bank Ltd.

4SI ABS

ISIN: ZAE000324059 SHORT: 4SIGHT CODE: 4SI ISIN: ZAE000079810 SHORT: ABSABANK-P CODE: ABSP

REG NO: 2022/852017/06 FOUNDED: 2017 LISTED: 2017 REG NO: 1986/004794/06 FOUNDED: 1986 LISTED: 2006

NATURE OF BUSINESS: 4Sight Holdings Ltd. (4Sight) is a public NATURE OF BUSINESS: Absa Bank Ltd. (the Company) is incorporated

company listed on the ‘JSE’ AltX incorporated on 29 June 2017 in and domiciled in South Africa and provides retail, business, corporate,

accordance with the laws of the Republic of Mauritius, specifically for the investment banking, and wealth management products and services. The

listing of the 4Sight Group on 19 October 2017. Company and its subsidiaries (the Group ) operate primarily in South

SECTOR: AltX Africa andemploy 27 085 people. The addressof the registered office of the

NUMBER OF EMPLOYEES: 0 Bank is 7th Floor, Absa Towers West, 15 Troye Street, Johannesburg,

DIRECTORS: Crowe C (ind ne), Mortimer M (ind ne), 2001. The Company has preference shares listed on the JSE Ltd.

Murgatroyd A (ind ne), Nel J (ind ne), Ramaphosa D (ind ne), SECTOR: Add—Debt—Preference Shares—Pref Shares

Patel K (Chair, ind ne), Zitzke T (CEO), van der Merwe E (CFO) NUMBER OF EMPLOYEES: 27 324

MAJOR ORDINARY SHAREHOLDERS as at 01 Mar 2024 DIRECTORS: Cummins J J (ind ne, UK), Hodge D (ne), Keanly R A (ne),

Silver Knight Trustees (Pty) Ltd. 22.52% Mjoli-Mncube N S (ld ind ne), Russon C (Interim CEO),

Jacobus Botha 17.71% Moloko M S (Chair Designate, ind ne), Rautenbach A (CEO),

Marie-Louise Zitzke 17.17% Raju D (Group FD), Abdool-Samad T (ind ne), Lucas-Bull W E (Chair, ind ne)

POSTAL ADDRESS: 6th Floor, Tower 1, NeXTeracom Building, Ebene, MAJOR PREFERRED SHAREHOLDERS as at 28 Oct 2024

Mauritius Absa Group Ltd. 100.00%

MORE INFO: www.sharedata.co.za/sdo/jse/4SI POSTAL ADDRESS: PO Box 7735, Johannesburg, 2000

COMPANY SECRETARY: Ian Cronje MORE INFO: www.sharedata.co.za/sdo/jse/ABSP

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. COMPANY SECRETARY: N R Drutman

DESIGNATEDADVISOR:JavaCapitalTrusteesandSponsors(Pty)Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Nexia SAB&T Inc. SPONSOR: Absa Bank Ltd. (Corporate and Investment Bank)

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: KPMG Inc., PwC Inc.

4SI Ords no par value - 534 334 631 CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] ABSP Prefs 1c ea 30 000 000 4 944 839

Ords no par value Ldt Pay Amt LIQUIDITY: Jan25 Avg 12 028 shares p.w., R9.4m(12.6% p.a.)

Final No 2 18 Jun 24 24 Jun 24 2.50

ALSH 40 Week MA ABSABANK-P

Interim No 1 12 Sep 23 18 Sep 23 2.50

LIQUIDITY: Jan25 Avg 831 996 shares p.w., R648 589.7(8.1% p.a.)

FINA 40 Week MA 4SIGHT 99524

96 86368

80 73212

63 60056

47 46900

2020 | 2021 | 2022 | 2023 | 2024 |

31

FINANCIAL STATISTICS

(R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

15

2020 | 2021 | 2022 | 2023 | 2024 | Interim Final Final(rst) Final(rst) Final(rst)

NOTES: 4Sight has changed its financial year-end from 31 December to Interest Paid 42 244 74 022 46 782 33 843 40 702

28 February. Interest Rcvd 64 964 118 377 89 169 72 144 73 886

The group changed its presentation currency from USD to ZAR from Operating Inc 11 022 23 016 25 036 21 799 18 687

1 January 2021.

Minority Int 506 899 609 582 589

FINANCIAL STATISTICS Attrib Inc 2 692 7 097 11 314 10 573 1 176

(Amts in ZAR’000) Aug 24 Feb 24 Dec 22 Dec 21 Dec 20 TotCompIncLoss 3 542 9 865 8 470 8 045 4 874

Interim Final Final Final(rst) Final(rst) Ord SH Int 103 144 100 665 98 414 97 075 89 752

Turnover 541 953 1 097 787 696 008 576 812 511 072 Dep & OtherAcc 1 357 484 1 299 378 1 218 898 1 101 392 1 035 079

Op Inc 35 569 39 041 22 076 11 384 17 974 Liabilities 1 479 841 1 425 493 1 376 250 1 247 980 1 191 876

NetIntPd(Rcvd) - 2 265 - 4 197 - 868 - 130 562 Inv & Trad Sec 313 143 301 645 289 482 261 937 276 635

Minority Int 231 902 1 019 749 5 316 Adv & Loans 1 164 600 1 139 935 1 105 723 1 009 508 933 420

Att Inc 27 657 32 204 15 404 11 172 10 572 ST Dep & Cash 55 078 41 510 37 344 33 751 33 812

TotCompIncLoss 27 965 32 866 16 240 11 915 15 721 Total Assets 1 587 629 1 530 802 1 479 308 1 349 699 1 286 275

Fixed Ass 33 536 33 253 32 165 31 007 31 404 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 263 254 259 860 204 452 160 249 153 545

312.50

- 1 652.00 2 598.70 2 392.60

Ord SH Int 319 706 305 330 286 724 287 503 276 530 HEPS-C (ZARc) 4 146.30 8 136.30 6 393.01 4 964.25 5 170.89

DPS (ZARc)

Minority Int 3 483 3 252 2 350 2 831 3 278

LT Liab 10 852 11 222 10 972 11 648 15 726 NAV PS (ZARc) 20 828.00 20 612.00 20 300.00 20 100.00 18 458.00

Tot Curr Liab 192 516 207 067 172 324 122 370 115 536 3 Yr Beta - 0.11 - 0.10 0.69 0.95 0.86

Price Prd End 74 245 74 899 86 499 81 249 58 903

PER SHARE STATISTICS (cents per share) Price High 78 000 90 350 99 057 82 000 74 500

HEPS-C (ZARc) 5.19 6.04 2.38 1.76 2.93 Price Low 70 800 71 830 80 052 55 060 45 000

DPS (ZARc) - 5.00 - - - RATIOS

NAV PS (ZARc) 59.93 57.14 44.27 43.63 34.77 Ret on SH Fund 5.93 7.59 11.57 10.97 1.87

3 Yr Beta - 0.65 - 0.47 0.98 0.77 0.94 RetOnTotalAss 1.41 1.52 1.71 1.64 1.46

Price High 92 120 30 42 75 Interest Mgn 0.03 0.03 0.03 0.03 0.03

Price Low 61 23 18 20 16 LiquidFnds:Dep 0.04 0.03 0.03 0.03 0.03

Price Prd End 75 75 25 22 28

RATIOS

Ret on SH Fnd 17.26 9.20 5.68 4.11 5.68

Oper Pft Mgn 6.56 3.56 3.17 1.97 3.52

D:E 0.03 0.04 0.04 0.04 0.06

Current Ratio 1.37 1.25 1.19 1.31 1.33

Div Cover - 1.21 - - -

66