Page 107 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 107

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – DAT

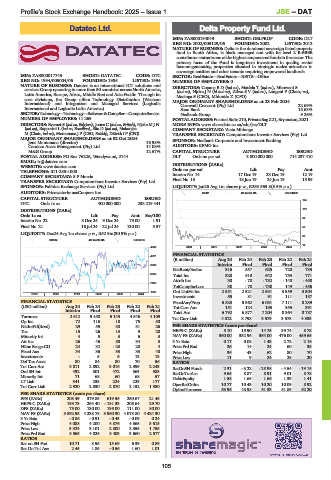

Datatec Ltd. Delta Property Fund Ltd.

DAT DEL

ISIN: ZAE000194049 SHORT: DELPROP CODE: DLT

REG NO: 2002/005129/06 FOUNDED: 2002 LISTED: 2012

NATURE OF BUSINESS: Delta is the dominant sovereign listed property

fund in South Africa, is black managed and with its level 2 B-BBEE

contributor statusis one of the highest empowered fundsin the sector. The

primary focus of the Fund is long-term investment in quality, rental

income-generating properties situated in strategic nodes attractive to

sovereign entities and other tenants requiring empowered landlords.

ISIN: ZAE000017745 SHORT: DATATEC CODE: DTC SECTOR: RealEstate—RealEstate—REITS—Office

REG NO: 1994/005004/06 FOUNDED: 1986 LISTED: 1994 NUMBER OF EMPLOYEES: 0

NATURE OF BUSINESS: Datatec is an international ICT solutions and DIRECTORS: CopansBD(ind ne), Matlala T (ind ne), Mboweni S

services Group operating in more than 50 countries across North America, (ind ne), NjekeJN(ld ind ne), ZilwaSV(ind ne), Langeni P (Chair, ne),

Latin America, Europe, Africa, Middle East and Asia-Pacific. Through its Masinga S (CEO), Mhlontlo Z (CFO)

core divisions, the Group offers Technology Distribution (Westcon MAJOR ORDINARY SHAREHOLDERS as at 23 Feb 2024

International) and Integration and Managed Services (Logicalis Cornwall Crescent (Pty) Ltd. 22.69%

International and Logicalis Latin America). Saxo Bank 15.63%

SECTOR:Technology—Technology—Software&CompSer—ComputerService Nedbank Group 9.26%

NUMBER OF EMPLOYEES: 11 269 POSTAL ADDRESS:PostnetSuite210, PrivateBagX21,Bryanston,2021

DIRECTORS: Everaet S (ind ne, Belgiam), Jones C (ind ne, British), Njeke M J N MORE INFO: www.sharedata.co.za/sdo/jse/DLT

(ind ne), Rapparini L (ind ne, Brazilian), SitaD(ind ne), Makanjee COMPANY SECRETARY: Vasta Mhlongo

M(Chair, ind ne), Montanana J P (CEO, British), Dittrich I P (CFO) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 02 Oct 2024 SPONSOR: Nedbank Corporate and Investment Banking

Jens Montanana (director) 16.98% AUDITORS: KPMG Inc.

Camissa Asset Management (Pty) Ltd. 14.08%

M&G Group 12.57% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 76226, Wendywood, 2144 DLT Ords no par val 3 000 000 000 714 237 410

EMAIL: ir@datatec.com DISTRIBUTIONS [ZARc]

WEBSITE: www.datatec.com Ords no par val Ldt Pay Amt

TELEPHONE: 011-233-1000 Interim No 14 17 Dec 19 23 Dec 19 12.19

COMPANY SECRETARY: S P Morris

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 13 18 Jun 19 24 Jun 19 15.99

SPONSOR: Pallidus Exchange Services (Pty) Ltd. LIQUIDITY: Jan25 Avg 1m shares p.w., R253 563.8(8.5% p.a.)

AUDITORS: PricewaterhouseCoopers Inc. REIV 40 Week MA DELPROP

CAPITAL STRUCTURE AUTHORISED ISSUED 145

DTC Ords 1c ea 400 000 000 233 219 441

118

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt Scr/100

92

Interim No 22 3 Dec 24 9 Dec 24 75.00 1.91

Final No 21 16 Jul 24 22 Jul 24 130.00 3.57 65

LIQUIDITY: Dec24 Avg 1m shares p.w., R52.9m(30.9% p.a.)

39

SCOM 40 Week MA DATATEC

12

4949 2020 | 2021 | 2022 | 2023 | 2024 |

FINANCIAL STATISTICS

4321

(R million) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21

3692 Interim Final Final Final Final

NetRent/InvInc 316 557 625 720 735

3064 Total Inc 328 610 642 753 771

Attrib Inc 30 - 70 - 732 - 148 - 458

2435

TotCompIncLoss 30 - 78 - 750 149 - 456

Ord UntHs Int 2 551 2 521 2 631 3 359 3 504

1807

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Investments 55 81 91 111 157

FINANCIAL STATISTICS FixedAss/Prop 5 823 5 362 6 081 7 111 8 239

(USD million) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21 Tot Curr Ass 151 124 193 355 391

Interim Final Final Final Final Total Ass 6 792 6 877 7 204 8 364 8 787

Turnover 2 612 5 458 5 143 4 546 4 109 Tot Curr Liab 4 012 3 798 3 579 3 575 4 333

Op Inc 72 116 18 75 50

NetIntPd(Rcvd) 29 55 38 31 26 PER SHARE STATISTICS (cents per share)

Tax 15 26 13 9 20 HEPS-C (ZARc) 5.10 15.90 14.75 39.74 8.78

Minority Int 4 5 3 6 3 NAV PS (ZARc) 360.00 352.96 364.00 476.00 489.65

Att Inc 26 46 80 34 3 3 Yr Beta 0.17 0.08 1.43 2.72 2.16

Hline Erngs-CO 24 32 - 23 28 4 Price Prd End 26 14 24 60 35

Fixed Ass 34 36 33 33 40 Price High 36 43 62 80 70

Investments - 5 6 13 13 Price Low 11 9 24 28 20

Def Tax Asset 80 84 80 70 56 RATIOS

Tot Curr Ass 3 011 2 892 3 016 2 399 2 243 RetOnSH Funds 2.31 - 3.22 - 28.98 - 4.54 - 13.15

Ord SH Int 492 501 472 563 583 RetOnTotAss 9.65 8.87 8.91 9.01 8.78

Minority Int 71 68 60 68 57 Debt:Equity 1.58 1.65 1.66 1.39 1.41

LT Liab 341 235 224 229 177 OperRetOnInv 10.77 10.43 10.20 10.09 8.92

Tot Curr Liab 2 920 2 830 2 870 2 152 1 980

OpInc:Turnover 53.96 48.98 51.33 51.83 52.20

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 208.49 379.85 619.55 250.67 21.45

HEPS-C (ZARc) 193.73 264.40 - 181.33 208.64 29.70

DPS (ZARc) 75.00 130.00 195.00 111.00 80.00

NAV PS (ZARc) 3 892.95 4 238.78 3 960.30 4 078.80 4 424.30

3 Yr Beta - 0.86 - 0.91 - 0.43 - 0.09 0.24

Price High 4 088 4 200 4 876 4 365 3 615

Price Low 3 324 3 101 2 800 2 355 1 755

Price Prd End 3 555 4 025 3 403 3 660 2 577

RATIOS

Ret on SH Fnd 10.71 8.95 15.69 6.39 0.89

Ret On Tot Ass 2.45 1.85 - 0.56 1.60 1.01

105