Page 105 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 105

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – COP

MAJOR ORDINARY SHAREHOLDERS as at 19 Jul 2024

Copper 360 Ltd. Public Investment Corporation (Pretoria) 16.09%

Allan Gray (Pty) Ltd. 10.00%

COP

ISIN: ZAE000318531 SHORT: COPPER360 CODE: CPR The Imvula Trust 7.52%

REG NO: 2021/609755/06 FOUNDED: 2021 LISTED: 2023 POSTAL ADDRESS: PO Box 44684, Claremont, Cape Town, 7735

NATUREOFBUSINESS:Thegrouphasconstructedahydrometallurgicalplant MORE INFO: www.sharedata.co.za/sdo/jse/CML

which extracts copper from copper oxide resources in Nababeep and COMPANY SECRETARY: Nazrana Hawa

surroundings in the Northen Cape province. Other BTC group operations TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

includeanumberofcoppersulphideprojectsinvaryingstagesofconsideration. SPONSOR: Valeo Capital (Pty) Ltd.

SECTOR: AltX AUDITORS: Ernst & Young

NUMBER OF EMPLOYEES: 0

DIRECTORS: Adams Q (ind ne), du PlessisLAS, Golding M (ind ne), CAPITAL STRUCTURE AUTHORISED ISSUED

Mathe Dr H (ld ind ne), Nelson J P, van Niekerk A (ind ne), CML Ords 0.01c ea 750 000 000 387 159 813

Smith R (Chair, ne), Hayes S A (CEO), Nel F (CFO), DISTRIBUTIONS [ZARc]

Thompson G V (COO) Ords 0.01c ea Ldt Pay Amt

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024 Final No 41 3 Dec 24 9 Dec 24 228.00

SA Hayes 55.00% Special No 2 10 Sep 24 16 Sep 24 153.00

POSTAL ADDRESS: 1 Main Road, Nababeep, Northern Cape, 8265

MORE INFO: www.sharedata.co.za/sdo/jse/CPR LIQUIDITY: Jan25 Avg 3m shares p.w., R112.5m(42.5% p.a.)

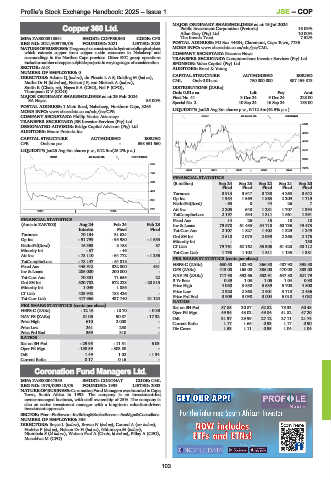

COMPANY SECRETARY: Phillip Venter Attorneys GENF 40 Week MA CORONAT

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

5541

DESIGNATED ADVISOR: Bridge Capital Advisors (Pty) Ltd.

AUDITORS: Moore Pretoria Inc. 4928

CAPITAL STRUCTURE AUTHORISED ISSUED

CPR Ords no par - 698 351 660 4314

LIQUIDITY: Jan25 Avg 3m shares p.w., R12.5m(25.2% p.a.) 3701

INDM 40 Week MA COPPER360

3087

858

2474

2020 | 2021 | 2022 | 2023 | 2024 |

729

FINANCIAL STATISTICS

600 (R million) Sep 24 Sep 23 Sep 22 Sep 21 Sep 20

Final Final Final Final Final

470

Turnover 3 913 3 647 3 738 4 263 3 642

Op Inc 1 954 1 569 1 863 2 209 1 719

341

NetIntPd(Rcvd) - 63 8 44 26 7

212 Att Inc 2 205 640 1 281 1 707 1 394

2023 | 2024 |

TotCompIncLoss 2 197 634 1 311 1 661 1 391

FINANCIAL STATISTICS Fixed Ass 14 26 15 18 18

(Amts in ZAR’000) Aug 24 Feb 24 Feb 23 Inv & Loans 79 578 61 483 54 718 60 786 49 473

Interim Final Final Tot Curr Ass 2 107 1 827 1 402 1 329 1 249

Turnover 70 134 31 624 - Ord SH Int 2 510 2 073 2 039 2 266 2 175

Op Inc - 91 799 - 95 980 - 1 633 Minority Int - - - - 130

NetIntPd(Rcvd) 16 353 8 158 87 LT Liab 79 761 62 162 55 305 61 428 50 112

Minority Int - 37 - 46 - Tot Curr Liab 1 798 1 102 1 511 1 135 1 381

Att Inc - 78 110 - 64 772 - 1 255

TotCompIncLoss - 78 147 - 64 818 - PER SHARE STATISTICS (cents per share)

Fixed Ass 445 918 322 800 431 HEPS-C (ZARc) 630.50 182.90 366.30 487.90 398.50

Inv & Loans 206 000 200 000 - DPS (ZARc) 413.00 165.00 386.00 470.00 383.00

Tot Curr Ass 70 331 71 655 22 NAV PS (ZARc) 717.98 592.66 582.91 647.80 621.79

Ord SH Int 520 782 572 228 - 20 815 3 Yr Beta 0.89 1.03 1.05 1.04 0.90

Minority Int 1 049 1 086 - Price High 4 080 3 850 5 639 5 700 4 500

LT Liab 425 948 183 426 - Price Low 2 920 2 868 2 901 3 710 2 436

Tot Curr Liab 417 966 437 740 31 124 Price Prd End 3 909 3 098 3 004 5 010 4 032

RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH Fnd 87.85 30.87 62.82 75.33 60.48

HEPS-C (ZARc) - 12.16 - 10.70 - 0.30

Oper Pft Mgn 49.94 43.02 49.84 51.82 47.20

NAV PS (ZARc) 81.06 90.87 - 17.32 D:E 31.97 29.99 27.12 27.11 21.74

Price High 610 2 000 - Current Ratio 1.17 1.66 0.93 1.17 0.90

Price Low 241 230 - Div Cover 1.53 1.11 0.95 1.04 1.04

Price Prd End 369 310 -

RATIOS

Ret on SH Fnd - 29.95 - 11.31 6.03

Oper Pft Mgn - 130.89 - 303.50 -

D:E 1.49 1.02 - 1.34

Current Ratio 0.17 0.16 -

Coronation Fund Managers Ltd.

COR

ISIN: ZAE000047353 SHORT: CORONAT CODE: CML

REG NO: 1973/009318/06 FOUNDED: 1993 LISTED: 2003

NATURE OF BUSINESS: Coronation Fund Managers was founded in Cape

Town, South Africa in 1993. The company is an investment-led,

owner-managed business, with staff ownership of 25%. The company is

also an active investment manager with a long-term valuation-driven

investment approach.

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians

NUMBER OF EMPLOYEES: 336

DIRECTORS: Boyce L (ind ne), Brown N (ind ne), Conrad A (snr ind ne),

Hadebe P (ind ne), Nelson Dr H (ind ne), Nhlumayo M (ind ne),

Ntombela S (ld ind ne), Watson Prof A (Chair, ld ind ne), Pillay A (CEO),

Musekiwa M (CFO)

103