Page 103 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 103

Profile’s Stock Exchange Handbook: 2025 – Issue 1 JSE – CLI

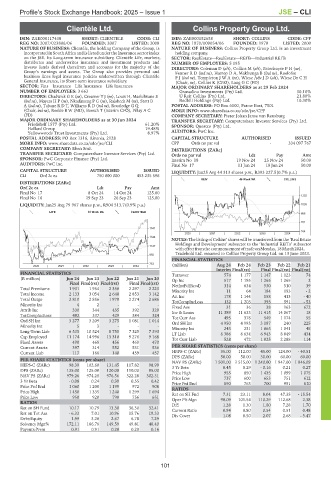

Clientèle Ltd. Collins Property Group Ltd.

CLI COL

ISIN: ZAE000117438 SHORT: CLIENTELE CODE: CLI ISIN: ZAE000152658 SHORT: COLLINS CODE: CPP

REG NO: 2007/023806/06 FOUNDED: 2007 LISTED: 2008 REG NO: 1970/009054/06 FOUNDED: 1970 LISTED: 2000

NATURE OF BUSINESS: Clientèle, the holding Company of the Group, is NATURE OF BUSINESS: Collins Property Group Ltd. is an investment

incorporated in South Africa and is listed under the Insurance sector index holding company.

on the JSE. Its Long-term insurance subsidiary, Clientèle Life, markets, SECTOR: RealEstate—RealEstate—REITs—Industrial REITs

distributes and underwrites insurance and investment products and NUMBER OF EMPLOYEES: 5 195

invests funds derived therefrom and accounts for the majority of the DIRECTORS: Coleman D (alt), Collins M (alt), EsterhuyseFH(ne),

Group’s earnings and assets. The Group also provides personal and FennerRD(ind ne), Harrop D A, Makhunga B (ind ne), Roelofse

business lines legal insurance policies underwritten through Clientèle PJ(ind ne), TempletonJWA(ne), Wiese AdvJD(alt), Wiese Dr C H

General Insurance, its Short-term insurance subsidiary. (Chair, ne), Collins K (CEO), Lang G C (FD)

SECTOR: Fins—Insurance—Life Insurance—Life Insurance MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

NUMBER OF EMPLOYEES: 3 663 Granadino Investments (Pty) Ltd. 30.10%

DIRECTORS: Chadwick G K (ne), Creamer T J (ne), Louw H, Mashilwane E U Reit Collins (Pty) Ltd. 21.80%

(ind ne), Mayers H P (ne), Nkadimeng P G (ne), Raisbeck M (ne), Stott B Redbill Holdings (Pty) Ltd. 10.30%

A(ind ne), Tabane R D T, Williams R D (ind ne), Routledge G Q POSTAL ADDRESS: PO Box 6100, Parow East, 7501

(Chair, ind ne), Reekie B W (MD), Boesch T (Interim CFO), Pillay A C MORE INFO: www.sharedata.co.za/sdo/jse/CPP

(FD) COMPANY SECRETARY: Pieter Johan Janse van Rensburg

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Friedshelf 1577 (Pty) Ltd. 61.20% SPONSOR: Questco (Pty) Ltd.

Hollard Group 19.48%

Yellowwoods Trust Investments (Pty) Ltd. 8.97% AUDITORS: PwC Inc.

POSTAL ADDRESS: PO Box 1316, Rivonia, 2128 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/CLI CPP Ords no par val - 334 097 767

COMPANY SECRETARY: Eben Smit DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords no par val Ldt Pay Amt

SPONSOR: PwC Corporate Finance (Pty) Ltd. Interim No 18 19 Nov 24 25 Nov 24 50.00

AUDITORS: PwC Inc. Final No 17 11 Jun 24 18 Jun 24 50.00

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jan25 Avg 44 313 shares p.w., R393 227.5(0.7% p.a.)

CLI Ord 2c ea 750 000 000 453 235 596

REIV 40 Week MA COLLINS

DISTRIBUTIONS [ZARc]

Ord2cea Ldt Pay Amt

Final No 17 8 Oct 24 14 Oct 24 125.00

1202

Final No 16 19 Sep 23 26 Sep 23 125.00

LIQUIDITY: Jan25 Avg 79 967 shares p.w., R904 513.7(0.9% p.a.) 1035

LIFE 40 Week MA CLIENTELE

868

701

1541

534

2020 | 2021 | 2022 | 2023 | 2024 |

1344

NOTES: The listing of Collins’ shares will be transferred from the ‘Real Estate

Holdings and Development’ subsector to the ‘Industrial REITs’ subsector

1147

witheffectfromthecommencementoftradeonMonday,18March2024.

950 Tradehold Ltd. renamed to Collins Property Group Ltd. on 13 June 2023.

FINANCIAL STATISTICS

753 (million) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21

2020 | 2021 | 2022 | 2023 | 2024 |

Interim Final(rst) Final Final(rst) Final(rst)

FINANCIAL STATISTICS Turnover 574 1 177 1 147 1 123 74

(R million) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20 Op Inc 517 1 195 1 265 1 265 2

Final Final(rst) Final(rst) Final Final(rst)

NetIntPd(Rcvd) 314 634 530 510 39

Total Premiums 1 931 1 954 2 358 2 297 2 223 Minority Int 11 64 184 193 - 2

Total Income 2 133 3 054 2 640 2 853 3 142 Att Inc 178 1 144 158 413 - 40

Total Outgo 2 810 2 856 1 979 2 274 2 686 TotCompIncLoss 132 1 203 393 591 - 53

Minority Int 4 2 - - - Fixed Ass 31 36 38 163 672

Attrib Inc 330 344 435 392 329 Inv & Loans 11 389 11 633 11 415 14 067 18

TotCompIncLoss 492 337 429 384 324 Tot Curr Ass 495 376 549 1 174 55

Ord SH Int 3 277 3 209 3 275 1 081 1 014 Ord SH Int 4 950 4 995 3 187 240 225

Minority Int 5 3 - - - Minority Int 243 231 1 065 1 041 45

Long-Term Liab 6 535 10 524 8 755 7 325 7 393 LT Liab 6 386 6 634 6 943 8 849 434

Cap Employed 11 174 14 996 13 310 9 276 9 168 Tot Curr Liab 528 472 1 025 2 288 114

Fixed Assets 490 468 456 460 470

Current Assets 397 314 552 531 536 PER SHARE STATISTICS (cents per share)

Current Liab 117 166 140 459 457 HEPS-C (ZARc) 35.00 112.00 45.00 124.00 - 40.51

DPS (ZARc) 50.00 50.00 30.00 60.00 60.00

PER SHARE STATISTICS (cents per share) NAV PS (ZARc) 1 501.00 1 515.00 1 240.00 1 947.00 1 846.09

HEPS-C (ZARc) 98.39 102.60 131.45 117.82 98.99 3 Yr Beta 0.45 0.29 - 0.16 0.21 0.27

DPS (ZARc) 125.00 125.00 120.00 110.00 95.00 Price High 955 850 1 435 1 099 1 075

NAV PS (ZARc) 979.26 974.28 976.56 322.28 302.31 Price Low 737 600 653 751 612

3 Yr Beta - 0.08 0.24 0.39 0.55 0.42 Price Prd End 890 763 700 951 810

Price Prd End 1 060 1 200 1 199 972 908 RATIOS

Price High 1 450 1 335 1 240 1 299 1 694 Ret on SH Fnd 7.31 23.11 8.04 47.35 - 15.54

Price Low 950 920 790 756 651 Oper Pft Mgn 90.09 101.54 110.29 112.68 2.38

RATIOS

D:E 1.28 1.30 1.80 7.28 1.70

Ret on SH Fund 10.17 10.79 13.30 36.30 32.41 Current Ratio 0.94 0.80 0.54 0.51 0.48

Ret on Tot Ass - 6.33 7.01 10.96 15.76 19.33 Div Cover 1.08 8.50 2.07 2.68 - 5.47

Debt:Equity 1.99 3.28 2.67 6.78 7.29

Solvency Mgn% 172.11 166.76 149.59 49.81 48.40

Payouts:Prem 0.91 0.91 0.20 0.20 0.16

101