Page 46 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 46

CTSE – ZXRPG Profile’s Stock Exchange Handbook: 2024 – Issue 4

Runway Property Group Ltd. Transformational Investment Portfolio

ZXRPG One Ltd.

ISIN: ZAEZ00000059 SHORT: RUNWAY CODE: ZXRPG

REG NO: 2019/547292/06 FOUNDED: 2019 LISTED: 2020 ZXTIP

NATURE OF BUSINESS: The Company is an internally asset-managed REIT ISIN: ZAEZ00000042 SHORT: 4ATIP ONE CODE: ZXTIP

which holds a portfolio of income-generating immovable properties focussed REG NO: 2017/458073/06 FOUNDED: 2017 LISTED: 2022

primarily in the retail sector (approximately 85% of the portfolio by GLA NATUREOF BUSINESS:TIP Onelistedonthe CTSEin January2022, with

being retail,with thebalancecomprising amixoflightindustrial,commercial a market capitalization of R7million at the time of listing. TIP One was

and residential), all of which are located in the greater Gauteng region. given a duration of 2 years from the initial listing date to reach a minimum

SECTOR: RealEstate—RealEstate—REITS—Retail market capitalisation of R25million in order to remain listed on the CTSE.

The finalisation of the PN Invest transaction has resulted in TIP One

NUMBER OF EMPLOYEES: 0 meeting the minimum market capitalisation requirements in order to

DIRECTORS: Bennett J (ind ne), Gluch A (ind ne), Zagnoev S (ind ne), remain listed on the CTSE.

Cendrowski R (Chair), Marks E (CEO), Kaplan Z (CFO) SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—Investment Services

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024 NUMBER OF EMPLOYEES: 0

Markscend (Pty) Ltd. 99.72%

POSTAL ADDRESS: PO Box 431, Bergbron, 1712 DIRECTORS: Mahura K (ind ne), Mokgele N (ind ne), Ngada N (ind ne),

Ntoi H (ld ind ne), Blount G (CIO, ne), Oliveira D D (CEO)

MORE INFO: www.sharedata.co.za/sdo/jse/ZXRPG POSTALADDRESS:2ndFloor,11KramerRoad,Kramerville,Sandton,2090

COMPANY SECRETARY: Juba Statutory Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/ZXTIP

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd. COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

AUDITORS: De Vos Richards Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: SizweNtsalubaGobodo Grant Thornton Inc.

ZXRPG Ords no par value 1 000 000 000 47 995 092

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] ZXTIP Ords no par 10 000 000 000 7 879 370

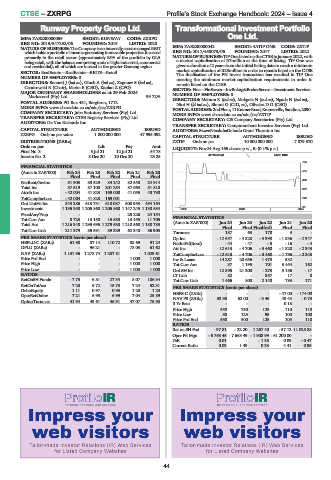

Ords no par Ldt Pay Amt LIQUIDITY: Nov24 Avg 165 shares p.w., R-(0.1% p.a.)

Final No 3 5 Jul 21 12 Jul 21 54.78

Interim No 2 8 Dec 20 10 Dec 20 23.25 40 Week MA 4ATIP ONE

750

FINANCIAL STATISTICS

(Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20 619

Final Final Final Final Final

NetRent/InvInc 81 903 83 529 84 242 82 558 24 914 488

Total Inc 87 519 87 100 201 254 87 663 51 818

357

Attrib Inc - 42 004 41 823 169 000 41 055 43 790

TotCompIncLoss - 42 004 41 823 169 001 - - 226

Ord UntHs Int 543 286 613 731 618 087 508 953 494 164

Investments 1 135 350 1 205 860 1 205 860 1 147 245 1 130 584 2022 | 2023 | 2024 95

FixedAss/Prop - - - 25 226 24 154 FINANCIAL STATISTICS

Tot Curr Ass 8 723 13 150 15 538 13 455 11 705

Total Ass 1 216 348 1 295 695 1 279 630 1 210 568 1 188 783 (Amts in ZAR’000) Jun 24 Jun 23 Jun 22 Jun 21 Jun 20

Final

Final

Final Final(rst)

Final

Tot Curr Liab 211 379 85 591 89 329 62 340 86 903

Turnover 187 63 178 3 -

PER SHARE STATISTICS (cents per share) Op Inc - 12 657 - 4 828 - 3 398 - 1 836 - 2 347

HEPLU-C (ZARc) 61.68 87.14 110.72 88.69 91.24 NetIntPd(Rcvd) - 44 - 47 - 5 - 16 - 4

DPLU (ZARc) - 96.21 - 78.03 61.62 Att Inc - 12 613 - 4 706 - 3 460 - 1 820 - 2 343

NAV (ZARc) 1 131.96 1 278.74 1 287.81 - 1 029.61 TotCompIncLoss - 12 613 - 4 706 - 3 460 - 1 796 - 2 343

Price Prd End - - - 1 000 1 000 Inv & Loans 14 287 20 656 1 473 532 -

Price High - - - 1 000 1 000 Tot Curr Ass 37 1 195 701 3 454 162

Price Low - - - 1 000 1 000 Ord SH Int 12 895 21 200 - 273 3 186 - 17

RATIOS LT Liab 82 - 357 17 8

RetOnSH Funds - 7.73 6.81 27.34 8.07 106.34 Tot Curr Liab 1 466 800 2 140 783 171

RetOnTotAss 7.20 6.72 15.73 7.24 52.31 PER SHARE STATISTICS (cents per share)

Debt:Equity 1.11 0.97 0.93 1.20 1.23 HEPS-C (ZARc) - - - - 47.00 - 174.00

OperRetOnInv 7.21 6.93 6.99 7.04 25.89

NAV PS (ZARc) 33.98 62.00 - 3.46 40.43 - 0.73

OpInc:Turnover 41.94 43.61 46.31 47.07 75.93

3 Yr Beta - - - 0.18 -

Price High 550 750 125 110 110

Price Low 80 125 95 100 100

Price Prd End 550 500 125 105 110

RATIOS

Ret on SH Fnd - 97.81 - 22.20 1 267.40 - 57.12 11 025.88

Oper Pft Mgn - 6 768.45 - 7 663.49 - 1 908.99 - 61 200.00 -

D:E 0.01 - - 1.35 0.09 - 0.47

Current Ratio 0.03 1.49 0.33 4.41 0.95

44