Page 43 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 43

Profile’s Stock Exchange Handbook: 2024 – Issue 4 CTSE – 4ABKB

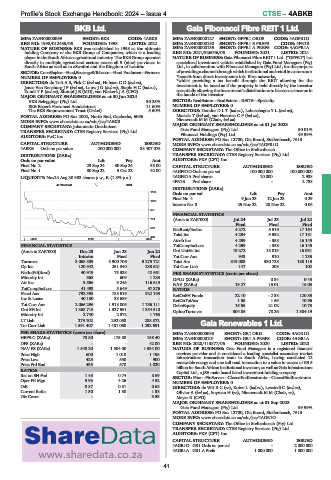

BKB Ltd. Gaia Fibonacci Fibre REIT 1 Ltd.

4ABKB 4AGFR1O

ISIN: ZAE400000069 SHORT: BKB CODE: 4ABKB ISIN: ZAE400000127 SHORT: GFFR1 ORDS CODE: 4AGFR1O

REG NO: 1998/012435/06 FOUNDED: 1998 LISTED: 2022 ISIN: ZAE400000150 SHORT: GFFR1 B PREFS CODE: 4FR1B

NATURE OF BUSINESS: BKB was established in 1998 as the ultimate ISIN: ZAE400000135 SHORT: GFFR1 A PREFS CODE: 4AGFR1A

holding Company of the BKB Group of Companies, which is a leading REG NO: 2021/926046/06 FOUNDED: 2021 LISTED: 2021

player in the South African agricultural industry. The BKB Group operates NATURE OF BUSINESS: Gaia Fibonacci Fibre REIT 1 Ltd. (“GFFR1") is a

directly in multiple agricultural sectors across all 9 (nine) provinces in specialised investment vehicle established by Gaia Fund Managers (Pty)

South Africa as well as in eSwatini and the Kingdom of Lesotho. Ltd., in collaboration with Fibonacci Managers (Pty) Ltd., for the purpose

SECTOR: ConsStaples—Food,Beverage&Tobacco—Food Producers—Farmers ofprovidingachannelthrough whichinstitutionalandretailinvestorscan:

NUMBER OF EMPLOYEES: 0 *benefit from direct investments into fibre networks,

DIRECTORS: du Toit A S, Fick C (ind ne), HobsonCD(ind ne), *whilst providing a tax benefit through the REIT allowing for the

Janse Van RensburgJF(ind ne), LouwJG(ind ne), StapleHC(ind ne), investment to be taxed as if the property is held directly by the investor

ZondiTP(ind ne), Stumpf J E (MD), van Niekerk J A (CFO) essentially allowing the investment’s distributions to be seen as income in

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 the hands of the investor.

VKB Beleggings (Pty) Ltd. 30.25% SECTOR: RealEstate—RealEstate—REITS—Specialty

BKB Beperk Personeel Aandeletrust 11.60% NUMBER OF EMPLOYEES: 0

The BKB Empowerment Trust (Ciskei) 5.50% DIRECTORS: DondurDLT(ind ne), LabuschagneYL(ind ne),

POSTAL ADDRESS: PO Box 2002, North End, Gqeberha, 6056 Masiela T (ind ne), van HeerdenCP(ind ne),

MORE INFO: www.sharedata.co.za/sdo/jse/4ABKB Nieuwoudt M M (Chair, ind ne)

COMPANY SECRETARY: Johannette Oosthuizen MAJOR ORDINARY SHAREHOLDERS as at 31 Jul 2023

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd. Gaia Fund Managers (Pty) Ltd. 50.01%

AUDITORS: PwC Inc. Fibonacci Holdings (Pty) Ltd. 49.99%

POSTAL ADDRESS: PO Box 12700, Die Boord, Stellenbosch, 7613

CAPITAL STRUCTURE AUTHORISED ISSUED MORE INFO: www.sharedata.co.za/sdo/jse/4AGFR1O

4ABKB Ords no par value 200 000 000 88 407 075 COMPANY SECRETARY: The Office in Stellenbosch

DISTRIBUTIONS [ZARc] TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

Ords no par value Ldt Pay Amt AUDITORS: PKF (CPT) Inc.

Final No 2 23 Sep 24 30 Sep 24 33.00 CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 1 30 Sep 22 3 Oct 22 42.00 4AGFR1O Ords no par val 100 000 000 100 000 000

LIQUIDITY: Nov24 Avg 30 983 shares p.w., R-(1.8% p.a.) 4AGFR1A Pref shares 10 000 2 938

4FR1B Pref share - 2 738

40 Week MA BKB

DISTRIBUTIONS [ZARc]

1185

Ords no par val Ldt Pay Amt

Final No 4 9 Jun 23 12 Jun 23 0.29

1028

Interim No 3 25 Nov 22 28 Nov 22 0.06

871

FINANCIAL STATISTICS

714 (Amts in ZAR’000) Jul 24 Jul 23 Jul 22

Final Final Final

557

NetRent/InvInc 4 272 5 516 17 164

Total Inc 4 294 5 592 17 181

400

| 2022 | 2023 | 2024 Attrib Inc 4 259 - 358 16 145

FINANCIAL STATISTICS TotCompIncLoss 4 259 - 358 16 145

(Amts in ZAR’000) Dec 23 Jun 23 Jun 22 Ord UntHs Int 19 272 15 013 16 031

Interim Final Final Tot Curr Ass 943 910 1 235

Turnover 3 068 839 5 900 706 5 275 721 Total Ass 319 003 330 728 188 115

Op Inc 120 542 251 340 238 621 Tot Curr Liab 147 208 102

NetIntPd(Rcvd) 40 919 75 338 42 661 PER SHARE STATISTICS (cents per share)

Minority Int 368 609 1 233 DPLU (ZARc) - 0.34 0.43

Att Inc 9 566 9 245 116 613 NAV (ZARc) 19.27 15.01 16.03

TotCompIncLoss 41 493 5 649 97 376 RATIOS

Fixed Ass 792 395 785 516 922 193 RetOnSH Funds 22.10 - 2.38 120.85

Inv & Loans 40 130 38 689 - RetOnTotAss 1.35 1.69 10.96

Tot Curr Ass 2 066 296 1 918 006 1 786 111 Debt:Equity 15.55 21.02 10.73

Ord SH Int 1 368 716 1 327 591 1 354 510 OpInc:Turnover 304.06 78.26 1 384.19

Minority Int 2 740 2 372 1 763

LT Liab 279 102 292 058 288 872

Tot Curr Liab 1 591 407 1 481 060 1 292 691 Gaia Renewables 1 Ltd.

4AGR1O

PER SHARE STATISTICS (cents per share) ISIN: ZAE400000093 SHORT: GR1 ORD CODE: 4AGR1O

HEPS-C (ZARc) 73.80 175.80 158.40 ISIN: ZAE400000101 SHORT: GR1 A PREFS CODE: 4AGR1A

DPS (ZARc) - - 42.00 REG NO: 2020/113877/06 FOUNDED: 2020 LISTED: 2020

NAV PS (ZARc) 1 548.20 1 504.00 1 534.00 NATURE OF BUSINESS: Gaia Fund Managers is a registered financial

Price High 600 1 010 1 195 services provider and is considered a leading specialist secondary market

Price Low 425 550 900 infrastructure transaction team in South Africa, having concluded 12

Price Prd End 435 570 1 020 renewable energy and one toll road transaction to a value in excess of R3.5

billion for South African institutional investors, as well as Gaia Infrastructure

RATIOS Capital Ltd., a JSE main board listed investment holding company.

Ret on SH Fnd 1.45 0.74 8.69 SECTOR: Fins—FinServcs—ClosedEndInvstmnts—ClosedEndInvstmnts

Oper Pft Mgn 3.93 4.26 4.52

NUMBER OF EMPLOYEES: 0

D:E 0.87 0.81 0.68 DIRECTORS: de WitRC(ne), Kotze L (ind ne), Lesetedi C (ind ne),

Current Ratio 1.30 1.30 1.38 Olivier A (ind ne), Snyman H (ne), Nieuwoudt M M (Chair, ne),

Div Cover - - 3.53 Meyer R (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 01 Sep 2023

Gaia Fund Managers (Pty) Ltd. 99.99%

POSTAL ADDRESS: PO Box 12700, Die Boord, Stellenbosch, 7613

MORE INFO: www.sharedata.co.za/sdo/jse/4AGR1O

COMPANY SECRETARY: The Office in Stellenbosch (Pty) Ltd.

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

AUDITORS: PKF (CPT) Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

4AGR1O GR1 Ords no par val - 2 000 000

4AGR1A GR1 A Prefs 1 000 000 1 000 000

41