Page 45 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 45

Profile’s Stock Exchange Handbook: 2024 – Issue 4 CTSE – 4AIHGH

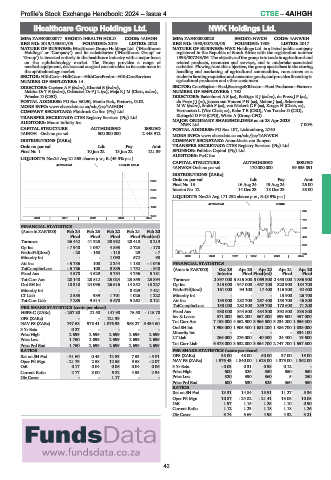

iHealthcare Group Holdings Ltd. NWK Holdings Ltd.

4AIHGH 4ANWKH

ISIN: ZAE400000077 SHORT: IHEALTH HOLD CODE: 4AIHGH ISIN: ZAE400000028 SHORT: NWKH CODE: 4ANWKH

REG NO: 2019/155531/06 FOUNDED: 2019 LISTED: 2020 REG NO: 1998/007243/06 FOUNDED: 1909 LISTED: 2017

NATURE OF BUSINESS: iHealthcare Group Holdings Ltd. (‘iHealthcare NATURE OF BUSINESS: NWK Holdings Ltd. is a listed public company

Holdings’ or ‘Company’) and its subsidiaries (‘iHealthcare Group’ or registered in the Republic of South Africa with the registration number

‘Group’) is invested entirely in the healthcare industry with a major focus 1998/007243/06. The objective of the group is to trade in agricultural and

on the ophthalmology market. The Group provides a range of related products, resources and services, and to undertake associated

medical-equipment, devices and surgical consumables to its customers in activities. Flowing from this objective, the group specialises in the storing,

the ophthalmology market. handling and marketing of agricultural commodities, runs stores as a

SECTOR: HlthCare—HtlhCare—HlthCarePrvdrs—HlthCareServices traderinfarmingrequisites andconsumergoods,andprovidesfinancingto

NUMBER OF EMPLOYEES: 14 agricultural producers and other customers.

DIRECTORS: Coetzee A P (ind ne), Khantsi B (ind ne), SECTOR: ConsStaples—Food,Beverage&Tobacco—Food Producers—Farmers

Maleka Dr T B (ind ne), Odendaal Dr P J L (ne), Moja K J M (Chair, ind ne), NUMBER OF EMPLOYEES: 1 762

Prinsloo D (CEO) DIRECTORS: Badenhorst A S (ne), Boëttger R J (ind ne), du Preez J P (ne),

POSTAL ADDRESS: PO Box 36290, Menlo Park, Pretoria, 0102 du PreezJJ(ne), Jansen van Vuuren P N (ne), Mahne J (ne), Schoeman

MORE INFO: www.sharedata.co.za/sdo/jse/4AIHGH MW(ind ne), Smith F (ne), van Niekerk C F (ne), Kruger H (Chair, ne),

COMPANY SECRETARY: Fluidrock Co Sec (Pty) Ltd. Vermooten L (Vice Chair, ne), Rabe T E (CEO), Van Tonder D (CIO),

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd. Kleingeld D P G (CFO), White A (Group CFO)

AUDITORS: Moore Infinity Inc. MAJOR ORDINARY SHAREHOLDERS as at 28 Apr 2023

NWK Ltd. 7.00%

CAPITAL STRUCTURE AUTHORISED ISSUED POSTAL ADDRESS: PO Box 107, Lichtenburg, 2740

4AIHGH Ords no par val 500 000 000 2 448 912 MORE INFO: www.sharedata.co.za/sdo/jse/4ANWKH

DISTRIBUTIONS [ZARc] COMPANY SECRETARY: Anna-Marie van Rooyen

Ords no par val Ldt Pay Amt TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

Final No 1 10 Jun 22 13 Jun 22 121.39 SPONSOR: Pallidus Capital (Pty) Ltd.

AUDITORS: PwC Inc.

LIQUIDITY: Nov24 Avg 21 353 shares p.w., R-(45.3% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

40 Week MA IHEALTH HOLD

4ANWKH Ords no par val 170 000 000 99 535 891

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

2509

Final No 13 16 Aug 24 19 Aug 24 26.00

2319 Interim No 12 14 Dec 23 18 Dec 23 35.00

LIQUIDITY: Nov24 Avg 171 292 shares p.w., R-(8.9% p.a.)

2130

40 Week MA NWKH

1940

825

1750

2020 | 2021 | 2022 | 2023 | 2024 712

FINANCIAL STATISTICS 599

(Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20

Final Final Final Final Final(rst) 486

Turnover 36 442 41 325 38 982 28 410 8 219

373

Op Inc - 7 940 1 067 4 893 2 723 - 170

NetIntPd(Rcvd) - 28 - 168 - 118 29 - 7 260

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Minority Int - - 1 090 572 98

Att Inc - 5 786 108 2 244 1 180 - 1 046 FINANCIAL STATISTICS

TotCompIncLoss - 5 786 108 3 335 1 752 - 948 (Amts in ZAR’000) Oct 23 Apr 23 Apr 22 Apr 21 Apr 20

Fixed Ass 4 578 4 629 5 754 4 756 5 181 Interim Final Final(rst) Final Final

Tot Curr Ass 20 148 28 512 25 024 23 855 23 894 Turnover 2 897 000 3 815 800 3 069 300 2 453 000 1 836 900

Ord SH Int 18 310 24 096 26 616 14 852 13 227 Op Inc 315 000 - 947 000 - 657 100 320 900 184 700

Minority Int - - - 8 429 7 421 NetIntPd(Rcvd) 161 000 94 100 17 400 116 300 92 600

LT Liab 2 585 939 1 701 1 026 1 222 Minority Int - - - 13 900 26 700

Tot Curr Liab 7 285 9 514 3 670 5 262 8 121 Att Inc 133 000 282 700 267 400 153 700 46 800

PER SHARE STATISTICS (cents per share) TotCompIncLoss 133 000 282 300 259 700 170 600 71 200

HEPS-C (ZARc) - 237.80 21.50 141.90 76.50 - 115.70 Fixed Ass 938 000 844 500 484 300 392 500 333 800

Inv & Loans 371 000 362 200 367 800 399 600 457 000

DPS (ZARc) - - 121.39 - -

NAV PS (ZARc) 747.68 978.41 1 076.93 963.27 3 434.60 Tot Curr Ass 7 153 000 4 362 900 3 966 500 3 234 200 1 956 300

3 Yr Beta 0.27 - - - - Ord SH Int 1 998 000 1 905 500 1 681 200 1 486 700 1 038 000

Price High 2 699 2 699 2 699 2 699 2 699 Minority Int - - - - 334 100

Price Low 1 750 2 699 2 699 2 699 2 699 LT Liab 266 000 276 000 40 300 24 400 19 600

Price Prd End 1 750 2 699 2 699 2 699 2 699 Tot Curr Liab 6 378 000 3 532 800 3 354 700 2 747 700 1 557 500

RATIOS PER SHARE STATISTICS (cents per share)

Ret on SH Fnd - 31.60 0.45 12.53 7.53 - 5.01 DPS (ZARc) 35.00 48.00 50.00 37.00 19.00

Oper Pft Mgn - 21.79 2.58 12.55 9.58 - 2.07 NAV PS (ZARc) 1 976.43 1 840.00 1 623.00 1 375.00 1 362.00

D:E 0.17 0.04 0.06 0.04 0.06 3 Yr Beta - 0.03 0.31 0.38 0.12 -

Current Ratio 2.77 3.00 6.82 4.53 2.94 Price High 600 825 550 550 550

Div Cover - - 1.17 - - Price Low 520 390 360 5 250

Price Prd End 600 530 525 360 550

RATIOS

Ret on SH Fnd 13.31 14.84 15.91 11.27 5.36

Oper Pft Mgn 10.87 - 24.82 - 21.41 13.08 10.05

D:E 1.97 1.15 1.25 1.10 0.90

Current Ratio 1.12 1.23 1.18 1.18 1.26

Div Cover 3.74 5.69 4.98 4.32 3.21

43