Page 154 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 154

JSE – NAS Profile’s Stock Exchange Handbook: 2024 – Issue 4

Naspers Ltd. Nedbank Group Ltd.

NAS NED

ISIN: ZAE000325783 SHORT: NASPERS-N CODE: NPN ISIN: ZAE000004875 SHORT: NEDBANK

REG NO: 1925/001431/06 FOUNDED: 1925 LISTED: 1994 CODE: NED REG NO: 1966/010630/06

NATURE OF BUSINESS: Established in 1915, Naspers has transformed FOUNDED: 1888 LISTED: 1969

itself to become a global consumer internet company and one of the largest NATURE OF BUSINESS: Nedbank Group, with

technology investorsinthe world.Through Prosus,the group operatesand assets of more than R1.3tn, is one of the largest

invests globally in markets with long-term growth potential, building financial services groups in Africa, offering

wholesale and retail banking, as well as

leading consumer internet companies that empower people and enrich insurance, asset management and wealth

communities. Prosus has its primary listing on Euronext Amsterdam and a management services and solutions to more

secondary listing on the Johannesburg Stock Exchange and Naspers is the than 7.3 million active clients. The group’s

majority owner of Prosus. ordinary shares have been listed on the JSE since

SECTOR: Technology—Technology—Software & CompSer—DigitalService 1969. In South Africa (SA), Nedbank has a strong franchise that

NUMBER OF EMPLOYEES: 25 564 contributes 90% of the group’s R1.3tn in assets and 80% of the group’s

R15.7bn headline earnings (HE).

DIRECTORS: Dubey S (ind ne), Kemna A (ind ne), Bloisi F (CEO), SECTOR: Fins—Banks—Banks—Banks

Bekker J P (Chair, ne), Sgourdos B (CFO), du ToitHJ(ld ind ne), NUMBER OF EMPLOYEES: 25 883 (permanent)

Enenstein C (ind ne), Girotra M (ind ne, Indian), Jafta ProfRCC(ind ne), DIRECTORS: Hermanus Dr M (ind ne), Nombembe T (ind ne),

LeteleFLN(ind ne), Meyer Prof D (ind ne), Oliveira de Lima R (ind ne), BrodyHR(ld ind ne), DamesBA(ind ne), Davis M (CFO),

PacakSJZ(ne), SorourMR(ne), StofbergJDT (Alternate, ind ne), DongwanaNP(ind ne), KrugerEM(ind ne), Langeni P (ind ne),

XuY(ind ne, China) LeithRAG(ne), Makalima L (ind ne), Mminele A D (Chair, ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 Nkuhlu M C (COO), Quinn J P (CE), Subramoney S (ind ne)

Public Investment Corporation Group 15.83% MAJOR ORDINARY SHAREHOLDERS as at 04 Sep 2024

POSTAL ADDRESS: PO Box 2271, Cape Town, 8000 Government Employees Pension Fund 15.37%

MORE INFO: www.sharedata.co.za/sdo/jse/NPN Allan Gray Ltd (SA) 6.88%

Coronation Asset Management (Pty) Ltd.

COMPANY SECRETARY: Lynelle Bagwandeen POSTAL ADDRESS: PO Box 1144, Johannesburg, 2000 5.06%

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. EMAIL: NedGroupIR@Nedbank.co.za

SPONSOR: Investec Bank Ltd. WEBSITE: www.nedbankgroup.co.za

AUDITORS: Deloitte & Touche Inc. TELEPHONE: 011-294-4444

CAPITAL STRUCTURE AUTHORISED ISSUED COMPANY SECRETARY: Jackie Katzin

NPN N Ords 2c ea 500 000 000 178 284 116 TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSORS:MerrillLynchSA(Pty)Ltd.t/aBofASecurities, NedbankCIB

DISTRIBUTIONS [ZARc] AUDITORS: Deloitte & Touche Inc., Ernst & Young Inc.

N Ords 2c ea Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 94 5 Dec 23 11 Dec 23 874.00 NED Ords 100c ea 600 000 000 488 020 500

Final No 93 4 Oct 22 10 Oct 22 660.23

DISTRIBUTIONS [ZARc]

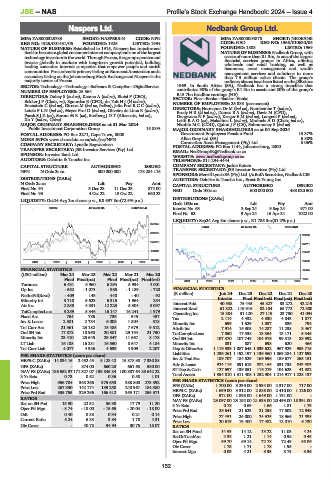

LIQUIDITY: Oct24 Avg 2m shares p.w., R8 697.8m(72.5% p.a.)

Ords 100c ea Ldt Pay Amt

SCOM 40 Week MA NASPERS-N Interim No 63 3 Sep 24 9 Sep 24 971.00

Final No 62 9 Apr 24 15 Apr 24 1022.00

LIQUIDITY: Sep24 Avg 8m shares p.w., R1 786.3m(81.2% p.a.)

370953

BANK 40 Week MA NEDBANK

308815

38900

246676

32711

184538

26522

122399

2019 | 2020 | 2021 | 2022 | 2023 | 2024 20333

FINANCIAL STATISTICS 14145

(USD million) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

Final Final(rst) Final Final(rst) Final(rst) 7956

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Turnover 6 431 5 960 6 294 5 934 4 001

Op Inc - 562 - 1 073 - 985 - 1 189 - 720 FINANCIAL STATISTICS

NetIntPd(Rcvd) - 409 143 440 - 40 - 92 (R million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final Final(rst) Final(rst) Final(rst)

Minority Int 3 710 5 623 6 315 1 964 254 Interest Paid 40 538 75 445 45 827 33 272 42 219

Att Inc 2 855 4 331 12 223 5 304 3 097 Interest Rcvd 61 322 116 915 82 104 65 772 72 300

TotCompIncLoss 3 259 5 346 16 147 16 241 1 979 Operating Inc 15 384 31 120 27 119 23 750 41 094

Fixed Ass 764 786 736 545 457 Tax 2 114 4 432 4 330 4 043 1 877

Inv & Loans 2 581 2 734 6 008 1 804 818 Minority Int 699 1 529 1 037 836 794

Tot Curr Ass 21 361 23 182 15 485 7 679 9 512 Attrib Inc 7 914 15 305 14 287 11 238 3 467

Ord SH Int 17 872 18 960 20 581 29 194 21 750 TotCompIncLoss 7 050 17 338 13 354 13 171 5 345

Minority Int 23 410 25 645 29 547 11 667 8 178 Ord SH Int 107 870 107 749 104 976 99 513 88 992

LT Liab 16 188 16 281 16 550 8 647 4 184 Minority Int 831 887 698 620 466

Tot Curr Liab 4 077 4 336 4 639 4 309 2 207 Dep & OtherAcc 1 119 539 1 087 645 1 039 622 967 929 953 715

PER SHARE STATISTICS (cents per share) Liabilities 1 236 261 1 192 197 1 136 960 1 069 284 1 127 693

265 151

184 529

HEPS-C (ZARc) 14 834.16 2 452.45 8 128.42 15 878.90 7 330.88 Inv & Trad Sec 189 707 891 619 169 596 189 677 843 303

Adv & Loans

924 116

831 735

882 165

DPS (ZARc) - 874.00 660.23 661.63 580.00 ST Dep & Cash 127 697 139 851 116 279 104 623 41 382

NAV PS (ZARc) 186 552.97 171 327.07 139 846.84 100 887.64 88 642.22 Total Assets 1 354 810 1 311 408 1 252 904 1 214 917 1 228 137

3 Yr Beta 0.73 0.52 0.36 0.58 1.01

Price High 356 784 358 266 375 653 388 800 273 592 PER SHARE STATISTICS (cents per share)

Price Low 267 330 142 174 139 250 240 967 184 380 EPS (ZARc) 1 700.00 3 239.00 2 934.00 2 317.00 717.00

1 699.00 3 312.00 2 888.00 2 410.00 1 126.00

HEPS-C (ZARc)

Price Prd End 335 755 329 296 166 412 353 171 255 371 DPS (ZARc) 971.00 1 893.00 1 649.00 1 191.00 -

RATIOS NAV PS (ZARc) 23 097.00 23 192.00 21 533.00 20 493.00 18 391.00

Ret on SH Fnd 15.90 22.32 36.98 17.79 11.20 3 Yr Beta 0.78 0.69 1.66 1.81 1.79

Oper Pft Mgn - 8.74 - 18.00 - 15.65 - 20.04 - 18.00 Price Prd End 25 641 21 623 21 258 17 502 12 948

D:E 0.40 0.38 0.34 0.21 0.14 Price High 27 451 24 000 24 625 18 966 21 898

Current Ratio 5.24 5.35 3.34 1.78 4.31 Price Low 20 619 19 400 17 482 12 010 6 730

Div Cover - 40.78 94.94 30.75 18.07 RATIOS

Ret on SH Fund 14.53 14.12 13.22 11.03 4.24

RetOnTotalAss 2.38 1.21 1.14 0.98 0.45

Oper Pft Mgn 69.70 69.14 72.78 72.49 68.06

Div Cover 1.75 1.71 1.78 1.95 -

Interest Mgn 0.03 4.21 3.93 3.73 3.36

152