Page 148 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 148

JSE – MON Profile’s Stock Exchange Handbook: 2024 – Issue 4

Mondi plc Montauk Renewables Inc.

MON MON

ISIN: GB00BMWC6P49 SHORT: MONDIPLC CODE: MNP ISIN: US61218C1036 SHORT: MNTKRENEW CODE: MKR

REG NO: 6209386 FOUNDED: 2007 LISTED: 2007 REG NO: 85-3189583 FOUNDED: 2020 LISTED: 2021

NATURE OF BUSINESS: Mondi is a global leader in packaging and paper, NATURE OF BUSINESS: Montauk is a fully-integrated renewable energy

contributing to a better world by producing products that are sustainable company specializing in the management, recovery, and conversion of

by design. We employ 22 000 people in more than 30 countries andoperate biogas into renewable energy. Montauk has over 30 years of experience in

an integrated business with expertise spanning the entire value chain, the development, operation, and management of biogas-fuelled renewable

enabling us to offer our customers a broad range of innovative solutionsfor energy projects. Montauk is a leader in renewable energy development

consumer and industrial end-use applications. Sustainability is at the from biogas. It specializes in developing projects which collectively benefit

centre of our strategy, with our ambitious commitments to 2030 focused all parties involved. The company’s portfolio is diversified and positioned

on circular driven solutions, created by empowered people, taking action to withstand market fluctuations, as well as to capture emerging trends

on climate. and future demand.

SECTOR: Inds—IndsGoods&Services—GeneralIndustr—Cont&Pckgng SECTOR: Energy—Energy—AltEnergy—AltFuels

NUMBER OF EMPLOYEES: 22 000 NUMBER OF EMPLOYEES: 151

DIRECTORS: Brandtzaeg S R (ind ne), Clark S (snr ind ne), Govil S (ind ne), DIRECTORS: AhmedMH(ind ne), CopelynJA(ne), Cunningham

Groth A (ind ne), Macozoma S (ind ne), Strank Dame A (ind ne), J(ind ne), Govender K (ne), Shaik Y (ind ne),

Williams D (ind ne, UK), Yea P (Chair, ne), King A (CEO), McClain S F (CEO, USA)

Young S (Sen Deputy Gvnr, ind ne, UK), Powell M (CFO) MAJOR ORDINARY SHAREHOLDERS as at 14 Apr 2023

MAJOR ORDINARY SHAREHOLDERS as at 22 Oct 2024 John A. Copelyn 40.10%

Public Investment Corporation SOC Ltd. 9.94% Peresec Prime Brokers (Pty) Ltd. 14.10%

BlackRock, Inc. 7.06% Theventheran G. Govender 12.20%

Allan Gray (Pty) Ltd. 6.01% POSTAL ADDRESS:680 AndersenDrive,5thFloor,Pittsburgh, PA,15220

POSTAL ADDRESS: Building 1, 1st Floor, Aviator Park, Station Road, MORE INFO: www.sharedata.co.za/sdo/jse/MKR

Addlestone, Surrey, United Kingdom, KT15 2PG COMPANY SECRETARY: John Ciroli

MORE INFO: www.sharedata.co.za/sdo/jse/MNP TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

COMPANY SECRETARY: Jenny Hampshire CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. MKR Ords USD0.01 ea 690 000 000 141 015 213

SPONSOR: Merrill Lynch SA (Pty) Ltd.

AUDITORS: PwC LLP LIQUIDITY: Oct24 Avg 197 651 shares p.w., R19.5m(7.3% p.a.)

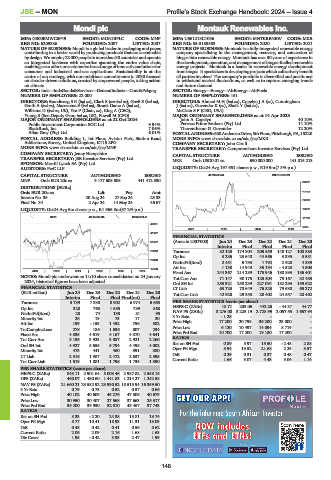

CAPITAL STRUCTURE AUTHORISED ISSUED 40 Week MA MNTKRENEW

MNP Ords EUR 20c ea 3 177 608 605 441 412 530 32367

DISTRIBUTIONS [EURc]

Ords EUR 20c ea Ldt Pay Amt 27224

Interim No 35 20 Aug 24 27 Sep 24 23.33

22080

Final No 34 2 Apr 24 14 May 24 46.67

LIQUIDITY: Oct24 Avg 5m shares p.w., R1 666.8m(57.2% p.a.) 16937

GENI 40 Week MA MONDIPLC

11793

46881

6650

2021 | 2022 | 2023 | 2024

41027

FINANCIAL STATISTICS

35172 (Amts in USD’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20

Interim Final Final Final Final

29318 Turnover 82 125 174 904 205 559 148 127 100 383

Op Inc 3 236 23 640 44 566 3 335 3 581

23463

NetIntPd(Rcvd) 2 451 5 753 1 792 2 928 4 339

17609 Att Inc 1 138 14 948 35 194 - 4 528 4 603

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Fixed Ass 244 367 214 289 175 946 180 893 186 401

NOTES: Mondi plc underwent an 11:10 share consolidation on 24 January Tot Curr Ass 71 147 90 175 125 804 75 167 32 485

2024, historical figures have been adjusted.

Ord SH Int 255 321 250 239 227 091 182 293 159 622

FINANCIAL STATISTICS LT Liab 63 723 70 649 76 823 79 630 65 272

(EUR million) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20 Tot Curr Liab 42 928 29 350 28 402 24 557 28 462

Interim Final Final Final(rst) Final

Turnover 3 739 7 330 8 902 6 974 6 663 PER SHARE STATISTICS (cents per share)

Op Inc 328 763 1 685 789 868 HEPS-C (ZARc) 18.71 203.06 442.26 - 44.37 44.77

NetIntPd(Rcvd) 28 74 138 81 95 NAV PS (ZARc) 3 276.00 3 225.19 2 728.99 2 057.55 1 657.94

Minority Int 26 19 73 17 20 3 Yr Beta - 1.28 - - - -

Att Inc 199 - 153 1 452 756 582 Price High 17 200 20 799 36 200 23 000 -

TotCompIncLoss 278 186 1 636 807 234 Price Low 6 120 10 497 14 094 8 719 -

Fixed Ass 4 835 4 619 4 167 4 870 4 641 Price Prd End 10 700 17 200 19 180 17 200 -

Tot Curr Ass 3 136 3 923 3 887 2 921 2 260 RATIOS

Ord SH Int 4 927 5 655 5 794 4 498 4 002 Ret on SH Fnd 0.89 5.97 15.50 - 2.48 2.88

Minority Int 473 441 460 391 380 Oper Pft Mgn 3.94 13.52 21.68 2.25 3.57

LT Liab 2 516 1 987 2 472 2 637 2 595 D:E 0.29 0.31 0.37 0.48 0.47

Tot Curr Liab 1 519 1 881 1 796 1 735 1 390 Current Ratio 1.66 3.07 4.43 3.06 1.14

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 843.11 2 901.64 5 003.46 2 987.82 2 558.16

DPS (ZARc) 460.07 1 480.60 1 441.83 1 214.27 1 242.58

NAV PS (ZARc) 21 660.21 23 582.92 23 990.52 18 515.94 16 359.50

3 Yr Beta 0.79 0.73 0.52 0.57 0.66

Price High 40 102 40 609 45 276 47 306 40 679

Price Low 30 950 30 407 27 568 37 663 25 317

Price Prd End 35 200 39 930 32 010 43 467 37 743

RATIOS

Ret on SH Fnd 8.33 - 2.20 24.38 15.81 13.74

Oper Pft Mgn 8.77 10.41 18.93 11.31 13.03

D:E 0.48 0.42 0.41 0.56 0.62

Current Ratio 2.06 2.09 2.16 1.68 1.63

Div Cover 1.95 - 0.42 3.93 2.47 1.99

146