Page 46 - shbh24_complete

P. 46

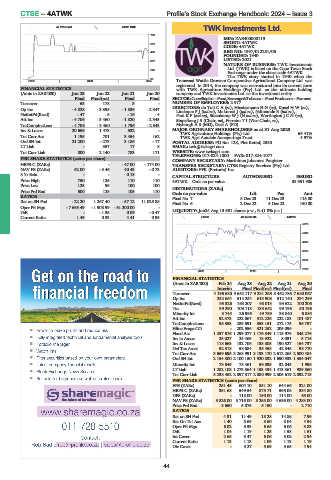

CTSE – 4ATWK Profile’s Stock Exchange Handbook: 2024 – Issue 3

TWK Investments Ltd.

40 Week MA 4ATIP ONE

750 4ATWK

ISIN: ZAE400000119

SHORT: 4ATWK

619

CODE: 4ATWK

REG NO: 1997/012251/06

488

FOUNDED: 1940

LISTED: 2021

357

NATURE OF BUSINESS: TWK Investments

Ltd. (TWK) is listed on the Cape Town Stock

226

Exchange under the share code 4ATWK.

The TWK story started in 1940 when the

95 Transvaal Wattle Growers Co-operative Agricultural Company Ltd. was

2022 | 2023 | 2024

registered. In 2014, the company was restructured into its current form

FINANCIAL STATISTICS with TWK Agriculture Holdings (Pty) Ltd. as the ultimate holding

(Amts in ZAR’000) Jun 23 Jun 22 Jun 21 Jun 20 company and TWK Investments Ltd. as the investment entity.

Final Final(rst) Final Final SECTOR:ConsStaples—Food,Beverage&Tobacco—FoodProducers—Farmers

Turnover 63 178 3 - NUMBER OF EMPLOYEES: 2 977

DIRECTORS: du ToitCA(ne), HiestermannHG(ne), KuselHW(ne),

Op Inc - 4 828 - 3 398 - 1 836 - 2 347 LindequePJ(ind ne), Mokorosi J (ind ne), Ndimande B (ind ne),

NetIntPd(Rcvd) - 47 - 5 - 16 - 4 PaulKP(ind ne), SteenkampWJ(ld ind ne), WartingtonJCN(ne),

Att Inc - 4 706 - 3 460 - 1 820 - 2 343 Stapelberg J S (Chair, ne), Ferreira T I (Vice Chair, ne),

TotCompIncLoss - 4 706 - 3 460 - 1 796 - 2 343 Myburgh A S (MD), Geel A (FD)

Inv & Loans 20 656 1 473 532 - MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2023 66.41%

TWK Agriculture Holdings (Pty) Ltd.

Tot Curr Ass 1 195 701 3 454 162 TWK Agri Aandele Aansporings Trust 4.97%

Ord SH Int 21 200 - 273 3 186 - 17 POSTAL ADDRESS: PO Box 128, Piet Retief, 2380

LT Liab - 357 17 8 EMAIL: twk@twkagri.com

Tot Curr Liab 800 2 140 783 171 WEBSITE: www.twkagri.com

TELEPHONE: 017-824-1000 FAX: 017-824-1077

PER SHARE STATISTICS (cents per share) COMPANY SECRETARY: Marthinus Johannes Potgieter

HEPS-C (ZARc) - - - 47.00 - 174.00 TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

NAV PS (ZARc) 62.00 - 3.46 40.43 - 0.73 AUDITORS: PFK (Pretoria) Inc.

3 Yr Beta - - 0.18 - CAPITAL STRUCTURE AUTHORISED ISSUED

Price High 750 125 110 110 4ATWK Ords no par value - 38 951 986

Price Low 125 95 100 100 DISTRIBUTIONS [ZARc]

Price Prd End 500 125 105 110 Ords no par value Ldt Pay Amt

RATIOS Final No 7 8 Dec 23 11 Dec 23 115.00

Ret on SH Fnd - 22.20 1 267.40 - 57.12 11 025.88 Final No 6 2 Dec 22 5 Dec 22 150.00

Oper Pft Mgn - 7 663.49 - 1 908.99 - 61 200.00 -

D:E - - 1.35 0.09 - 0.47 LIQUIDITY: Jun24 Avg 13 681 shares p.w., R-(1.8% p.a.)

Current Ratio 1.49 0.33 4.41 0.95 FOOD 40 Week MA 4ATWK

5575

5035

4496

3956

3416

2876

2022 | 2023 |

FINANCIAL STATISTICS

(Amts in ZAR’000) Feb 24 Aug 23 Aug 22 Aug 21 Aug 20

Interim Final Final(rst) Final(rst) Final

Turnover 4 196 680 9 652 117 9 231 265 8 452 786 7 680 067

Op Inc 252 664 514 254 613 908 512 140 294 299

NetIntPd(Rcvd) 95 326 163 207 98 013 93 622 100 206

Tax 39 290 109 118 133 642 99 196 50 196

Minority Int 3 745 26 996 49 759 33 840 6 885

Att Inc 92 373 222 667 312 226 222 183 101 487

TotCompIncLoss 95 353 289 691 353 151 272 175 96 757

Hline Erngs-CO - 202 556 321 252 205 096 -

Fixed Ass 1 257 676 1 299 077 1 176 549 1 115 979 845 276

Inv in Assoc 25 027 24 469 18 922 8 031 3 716

Inv & Loans 118 663 132 706 138 805 190 527 154 737

Def Tax Asset 52 318 58 584 35 458 42 345 98 770

Tot Curr Ass 3 659 695 3 268 991 3 133 170 2 612 265 2 500 484

Ord SH Int 2 154 800 2 100 150 1 920 832 1 690 533 1 354 047

Minority Int 73 549 73 461 59 095 32 045 1 996

LT Liab 1 282 108 1 273 864 1 153 434 1 413 361 989 560

Tot Curr Liab 3 238 462 2 897 317 2 880 999 2 305 619 2 092 715

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 251.45 604.10 851.10 644.66 321.00

HEPS-C (ZARc) 351.68 549.54 875.71 595.08 384.80

DPS (ZARc) - 115.00 150.00 114.00 65.00

NAV PS (ZARc) 5 826.00 5 716.00 5 255.00 4 636.00 4 283.00

Price Prd End 3 650 5 075 5 150 - 2 710

RATIOS

Ret on SH Fnd 4.31 11.49 18.28 14.86 7.99

Ret On Tot Ass 1.40 5.69 8.60 8.04 4.54

Oper Pft Mgn 6.02 5.33 6.65 6.06 3.83

D:E 1.04 1.19 1.25 1.58 1.61

Int Cover 2.65 3.47 6.06 5.08 2.94

Current Ratio 1.13 1.13 1.09 1.13 1.19

Div Cover - 5.27 5.69 5.65 4.94

44