Page 42 - shbh24_complete

P. 42

CTSE – 4AAVC Profile’s Stock Exchange Handbook: 2024 – Issue 3

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023

AltVest Capital Ltd. K2022679730 (SA) (Pty) Ltd. 46.00%

International Finance Corporation 19.30%

4AAVC

ISIN: ZAE400000143 SHORT: ALTVEST CODE: 4AAVC WDB Investment Holdings (Pty) Ltd. 12.70%

ISIN: ZAE400000192 SHORT: 4ACOF CODE: 4ACOF POSTAL ADDRESS: PO Box 35900, Menlo Park, Pretoria, 0102

ISIN: ZAE400000176 SHORT: 4AVBAM CODE: 4AVBAM MORE INFO: www.sharedata.co.za/sdo/jse/4AASP

ISIN: ZAE400000168 SHORT: ALTVEST-P CODE: 4AVUMG COMPANY SECRETARY: Wilna van Zyl

REG NO: 2021/540736/06 FOUNDED: 2021 LISTED: 2022 TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

NATURE OF BUSINESS: AltVest is an investment holding company that

seeks to democratise alternative investments, bringing bespoke investment SPONSOR: Pallidus Capital (Pty) Ltd.

opportunities to ordinary people and to engage and leverage trusted media AUDITORS: KPMG Inc.

platformstoeducateandraiseawarenessoftheinvestmentopportunities. CAPITAL STRUCTURE AUTHORISED ISSUED

SECTOR:Fins—FinServcs—OpEnd&MiscelInvVeh—OpEnd&MiscelInvVeh 4AASP Ord shrs of 0.1c ea 5 700 000 000 428 126 329

NUMBER OF EMPLOYEES: 10 DISTRIBUTIONS [ZARc]

DIRECTORS: Alcock G (ind ne), Barnhoorn H (ne), Baynham J (ind ne), Ordshrsof0.1cea Ldt Pay Amt

Kumalo B (ind ne), Mukkadam F (ne), Sithole K (ind ne),

Masie S C (Chair, ind ne), Wheatley W (CEO) Final No 6 13 Oct 23 16 Oct 23 68.00

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024 Special No 4 13 Oct 23 16 Oct 23 64.00

WGW Capital (Pty) Ltd. 33.90% LIQUIDITY: Jul24 Avg 119 300 shares p.w., R-(1.4% p.a.)

Tatum Keshwar Investments (Pty) Ltd. 16.90%

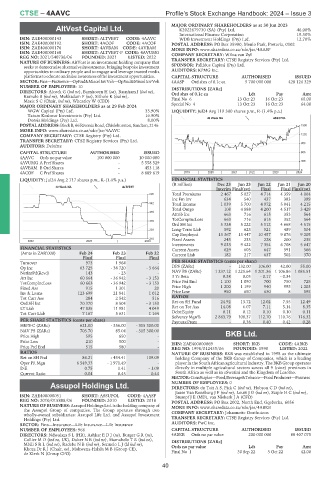

Dorsia Holdings (Pty) Ltd. 8.00% 40 Week MA ASSUPOL

POSTALADDRESS:BlockB,66RivoniaRoad,Chislehurston,Sandton,2146 1500

MORE INFO: www.sharedata.co.za/sdo/jse/4AAVC

COMPANY SECRETARY: CTSE Registry (Pty) Ltd. 1202

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

AUDITORS: Deloitte 903

CAPITAL STRUCTURE AUTHORISED ISSUED 605

4AAVC Ords no par value 100 000 000 10 000 000

4AVUMG A Pref Shares - 5 558 529 306

4AVBAM B Ord Shares - 453 118

4ACOF C Pref Shares - 8 889 619 2019 | 2020 | 2021 | 2022 | 2023 | 2024 8

LIQUIDITY: Jul24 Avg 2 717 shares p.w., R-(1.4% p.a.) FINANCIAL STATISTICS

(R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

40 Week MA ALTVEST

Interim Final(rst) Final Final Final(rst)

625 Total Premiums 2 467 5 027 4 714 4 359 4 004

Inc Fm Inv 634 540 437 383 399

542 Total Income 1 039 5 700 4 972 5 041 4 215

Total Outgo 108 4 888 4 200 4 517 3 429

459

Attrib Inc 663 716 615 353 564

TotCompIncLoss 663 716 615 352 564

376

Ord SH Int 5 324 5 222 5 112 4 668 4 515

293 Long-Term Liab 592 623 521 489 504

Cap Employed 13 367 13 447 10 457 9 876 9 205

210 Fixed Assets 243 233 228 200 235

2022 | 2023 | 2024

Investments 9 023 9 422 7 354 6 708 5 647

FINANCIAL STATISTICS Current Assets 629 605 647 591 566

(Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Current Liab 182 217 637 502 370

Final Final Final

Turnover 973 1 964 - PER SHARE STATISTICS (cents per share)

Op Inc 63 725 - 38 720 - 3 664 DPS (ZARc) - 132.00 106.00 42.00 55.00

NetIntPd(Rcvd) 143 - 23 - NAV PS (ZARc) 1 237.12 1 225.64 1 201.36 1 106.86 1 085.51

Att Inc 60 664 - 36 942 - 3 153 3 Yr Beta 0.38 0.03 - 0.17 - 0.34 -

TotCompIncLoss 60 663 - 36 942 - 3 153 Price Prd End 1 100 1 090 700 750 725

Fixed Ass 915 1 301 20 Price High 1 200 1 199 940 995 1 203

Inv & Loans 123 699 21 841 1 012 Price Low 950 650 630 8 595

Tot Curr Ass 284 2 542 516 RATIOS

Ord SH Int 70 370 8 504 - 3 153 Ret on SH Fund 24.92 13.72 12.02 7.55 12.49

LT Liab 47 835 11 981 4 049 Ret on Tot Ass 14.08 6.07 7.11 5.14 8.35

Tot Curr Liab 7 167 5 631 1 164 Debt:Equity 0.11 0.12 0.10 0.10 0.11

Solvency Mgn% 2 863.79 108.37 112.70 110.76 116.32

PER SHARE STATISTICS (cents per share) Payouts:Prem - 0.38 0.40 0.42 0.28

HEPS-C (ZARc) 621.00 - 356.00 - 315 300.00

NAV PS (ZARc) 703.70 85.04 - 315 300.00

Price High 595 650 - BKB Ltd.

Price Low 210 500 - ISIN: ZAE400000069 SHORT: BKB CODE: 4ABKB

4ABKB

Price Prd End 515 580 - REG NO: 1998/012435/06 FOUNDED: 1998 LISTED: 2022

RATIOS NATURE OF BUSINESS: BKB was established in 1998 as the ultimate

Ret on SH Fnd 86.21 - 434.41 109.09 holding Company of the BKB Group of Companies, which is a leading

Oper Pft Mgn 6 549.33 - 1 971.49 - player in the South African agricultural industry. The BKB Group operates

D:E 0.75 1.41 - 1.09 directly in multiple agricultural sectors across all 9 (nine) provinces in

Current Ratio 0.04 0.45 0.44 South Africa as well as in eSwatini and the Kingdom of Lesotho.

SECTOR:ConsStaples—Food,Beverage&Tobacco—FoodProducers—Farmers

Assupol Holdings Ltd. NUMBER OF EMPLOYEES: 0

DIRECTORS: du Toit A S, Fick C (ind ne), HobsonCD(ind ne),

4AASP Janse Van RensburgJF(ind ne), LouwJG(ind ne), StapleHC(ind ne),

ISIN: ZAE400000051 SHORT: ASSUPOL CODE: 4AASP Stumpf J E (MD), van Niekerk J A (CFO)

REG NO: 2010/015888/06 FOUNDED: 2010 LISTED: 2018 POSTAL ADDRESS: PO Box 2002, North End, Gqeberha, 6056

NATURE OF BUSINESS: Assupol Holdings Ltd. is the holding company of MORE INFO: www.sharedata.co.za/sdo/jse/4ABKB

the Assupol Group of companies. The Group operates through two COMPANY SECRETARY: Johannette Oosthuizen

wholly-owned subsidiaries: Assupol Life Ltd. and Assupol Investment

Holdings (Pty) Ltd. TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

SECTOR: Fins—Insurance—Life Insurance—Life Insurance AUDITORS: PwC Inc.

NUMBER OF EMPLOYEES: 966 CAPITAL STRUCTURE AUTHORISED ISSUED

DIRECTORS: Ndwalaza S L (HR), AshkarEDJ(ne), BurgerGR(ne), 4ABKB Ords no par value 200 000 000 88 407 075

CollierMD(ind ne, UK), DukerNB(ind ne), MamaboloTR(ind ne), DISTRIBUTIONS [ZARc]

MbiliSRL(ind ne), RadebeNB(ind ne), SenneloLJ(ld ind ne),

Khoza Dr R J (Chair, ne), Mokwena-Halala M B (Group CE), Ords no par value Ldt Pay Amt

de Klerk N (Group CFO) Final No 1 30 Sep 22 3 Oct 22 42.00

40