Page 117 - shbh24_complete

P. 117

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – FIN

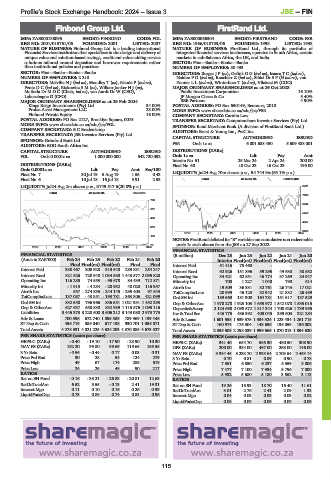

Finbond Group Ltd. FirstRand Ltd.

FIN FIR

ISIN: ZAE000138095 SHORT: FINBOND CODE: FGL ISIN: ZAE000066304 SHORT: FIRSTRAND CODE: FSR

REG NO: 2001/015761/06 FOUNDED: 2001 LISTED: 2007 REG NO: 1966/010753/06 FOUNDED: 1998 LISTED: 1998

NATURE OF BUSINESS: Finbond Group Ltd. is a leading international NATURE OF BUSINESS: FirstRand Ltd., through its portfolio of

Financial Services institution that specialises in the design and delivery of integrated financial services businesses, operates in South Africa, certain

unique value and solution-based savings, credit and value adding service markets in sub-Saharan Africa, the UK, and India.

solutions tailored around depositor and borrower requirements rather SECTOR: Fins—Banks—Banks—Banks

than institutional policies and practices. NUMBER OF EMPLOYEES: 50 493

SECTOR: Fins—Banks—Banks—Banks DIRECTORS: BurgerJP(ne), GelinkGG(ind ne), IsaacsTC(ind ne),

NUMBER OF EMPLOYEES: 2 210 NaidooPD(ind ne), Roscherr Z (ind ne), Sibisi DrSP(ld ind ne), von

DIRECTORS: MelvilleNJ(ind ne), Moodley T (ne), Naude P (ind ne), ZeunerLL(ind ne), Winterboer T (ind ne), Vilakazi M (COO)

PentzDC(ind ne), RiskowitzSM(ne), Wilken-JonkerHJ(ne), MAJOR ORDINARY SHAREHOLDERS as at 26 Oct 2023

Motlatla DrMDC (Chair, ind ne), van Aardt Dr W (CEO), Public Investment Corporation 16.10%

Labuschagne G (CFO) JP Morgan Chase & Co. 5.40%

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024 BEE Partners 4.90%

Kings Reign Investments (Pty) Ltd. 34.00% POSTAL ADDRESS: PO Box 650149, Benmore, 2010

Protea Asset Management LLC 23.00% MORE INFO: www.sharedata.co.za/sdo/jse/FSR

Finbond Private Equity 16.00% COMPANY SECRETARY: Carnita Low

POSTAL ADDRESS: PO Box 2127, Brooklyn Square, 0075 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/FGL SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

COMPANY SECRETARY: B C Bredenkamp AUDITORS: Ernst & Young Inc., PwC Inc.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: Grindrod Bank Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: BDO South Africa Inc. FSR Ords 1c ea 6 001 688 450 5 609 488 001

DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED

FGL Ords 0.0001c ea 1 000 000 000 542 720 092 Ords 1c ea Ldt Pay Amt

Interim No 51 25 Mar 24 2 Apr 24 200.00

DISTRIBUTIONS [ZARc] Final No 50 10 Oct 23 16 Oct 23 195.00

Ords 0.0001c ea Ldt Pay Amt Scr/100

FinalNo 7 30 Jul19 5 Aug 19 1.55 0.43 LIQUIDITY: Jul24 Avg 70m shares p.w., R4 744.9m(65.1% p.a.)

Final No 6 10 Jul 18 16 Jul 18 9.91 2.53 BANK 40 Week MA FIRSTRAND

LIQUIDITY: Jul24 Avg 2m shares p.w., R749 517.6(20.8% p.a.) 8731

BANK 40 Week MA FINBOND

7638

759

6544

612

5450

466

4357

319

3263

2019 | 2020 | 2021 | 2022 | 2023 | 2024

173

NOTES: FirstRand delisted its “B” variable non cumulative non redeemable

prefs 1c each shares from the JSE on 27 Sep 2022.

26

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS

FINANCIAL STATISTICS (R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

(Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20 Interim Final(rst) Final(rst) Final(rst) Final(rst)

Final Final(rst) Final(rst) Final Final Interest Paid 51 416 75 460 - - -

Interest Paid 330 467 308 928 313 548 289 831 254 247 Interest Rcvd 92 926 151 896 59 295 49 630 38 532

Interest Rcvd 821 526 720 948 1 034 530 1 443 577 2 095 820 Operating Inc 34 421 62 851 46 774 37 269 24 947

Operating Inc 116 285 74 553 - 95 678 84 439 712 871 Minority Int 700 1 227 1 040 790 614

Minority Int - 1 913 - 4 284 - 28 932 40 020 116 957 Attrib Inc 19 509 36 331 32 761 26 743 17 021

Attrib Inc 557 - 274 835 - 244 145 - 295 403 97 643 TotCompIncLoss 20 999 46 128 32 942 21 832 26 489

TotCompIncLoss 137 087 - 43 851 - 193 781 - 363 806 421 099 Ord SH Int 189 669 181 300 164 781 151 617 137 529

Ord SH Int 832 558 796 966 836 551 1 021 931 1 452 293 Dep & OtherAcc 1 978 278 1 923 103 1 655 972 1 542 078 1 535 015

Dep & OtherAcc 627 637 658 830 832 939 1 115 576 1 095 116 Deposits&Accep 2 124 698 2 098 572 1 817 344 1 700 626 1 739 955

Liabilities 3 446 373 3 228 600 3 606 212 3 143 080 2 973 773 Inv & Trad Sec 446 775 436 392 403 045 389 603 321 284

Adv & Loans 700 596 672 740 1 095 389 789 969 1 139 446 Adv & Loans 1 601 558 1 539 375 1 334 324 1 223 434 1 261 715

ST Dep & Cash 455 719 585 040 617 138 930 701 1 055 871 ST Dep & Cash 160 974 175 304 143 636 135 059 136 002

Total Assets 4 278 331 4 021 225 4 624 203 4 370 085 4 673 527 Total Assets 2 335 508 2 298 039 1 999 569 1 870 013 1 894 620

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 0.40 - 19.10 - 17.90 - 23.90 10.30 HEPS-C (ZARc) 341.40 654.70 585.30 480.50 308.90

NAV PS (ZARc) 182.20 99.80 99.69 119.65 165.55 DPS (ZARc) 200.00 384.00 467.00 263.00 146.00

3 Yr Beta - 0.56 - 0.44 0.17 0.03 0.31 NAV PS (ZARc) 3 384.45 3 233.70 2 938.64 2 703.54 2 453.14

Price Prd End 30 28 54 124 279 3 Yr Beta 0.70 0.81 0.89 0.90 0.78

Price High 49 67 174 285 519 Price Prd End 7 351 6 850 6 237 5 359 3 806

Price Low 24 25 48 90 217 Price High 7 477 7 100 7 934 5 796 7 000

RATIOS Price Low 5 932 5 680 5 180 3 552 3 113

Ret on SH Fund - 0.16 - 35.21 - 26.83 - 20.81 12.63 RATIOS

RetOnTotalAss 6.52 5.55 - 0.13 2.41 19.31 Ret on SH Fund 19.26 18.93 18.70 16.40 11.61

Interest Mgn 0.11 0.10 0.16 0.26 0.39 RetOnTotalAss 3.01 2.76 2.41 2.09 1.33

LiquidFnds:Dep 0.73 0.89 0.74 0.83 0.96 Interest Mgn 0.04 0.03 0.03 0.03 0.02

LiquidFnds:Dep 0.08 0.09 0.09 0.09 0.09

115