Page 122 - shbh24_complete

P. 122

JSE – GRA Profile’s Stock Exchange Handbook: 2024 – Issue 3

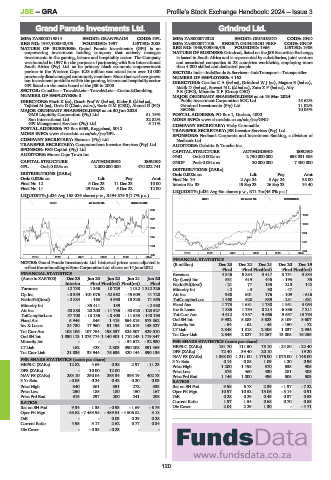

Grand Parade Investments Ltd. Grindrod Ltd.

GRA GRI

ISIN: ZAE000119814 SHORT: GRANPRADE CODE: GPL ISIN: ZAE000072328 SHORT: GRINDROD CODE: GND

REG NO: 1997/003548/06 FOUNDED: 1997 LISTED: 2008 ISIN: ZAE000071106 SHORT: GRINDROD PREF CODE: GNDP

NATURE OF BUSINESS: Grand Parade Investments (GPI) is an REG NO: 1966/009846/06 FOUNDED: 1966 LISTED: 1986

empowering investment holding company that actively manages NATURE OF BUSINESS: Grindrod, listed on the JSE Securities Exchange,

investments in the gaming, leisure and hospitality sector. The Company is based in South Africa and is represented by subsidiaries, joint venture

was founded in 1997 for the purpose of partnering with Sun International and associated companies in 23 countries worldwide, employing more

South Africa (Pty) Ltd. as its primary black economic empowerment than 4 000 skilled and dedicated people.

partner in the Western Cape. R28 million was raised from over 10 000 SECTOR: Inds—IndsGoods & Services—IndsTransport—TransportSer

previously disadvantagedcommunity members. Since then we have grown NUMBER OF EMPLOYEES: 4 162

our investment portfolio within the gaming, leisure and hospitality sector. DIRECTORS: CarolusCA(ind ne), GrindrodWJ(ne), Magara B (ind ne),

GPI listed on the main board of the JSE in 2008. Malik D (ind ne), SowaziNL(ld ind ne), ZatuZP(ind ne), Ally

SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Casino&Gambling F B (CFO), Mbambo X F (Group CEO)

NUMBER OF EMPLOYEES: 0 MAJOR ORDINARY SHAREHOLDERS as at 19 Mar 2024

DIRECTORS: Finch K (ne), Geach Prof W (ind ne), Kader R (ld ind ne), Public Investment Corporation SOC Ltd. 15.62%

Tajbhai M (ne), Orrie G (Chair, ind ne), Bortz G M (CEO), Ahmed G (FD) Grindrod Investments (Pty) Ltd. 11.02%

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023 36ONE 10.05%

GMB Liquidity Corporation (Pty) Ltd. 51.19% POSTAL ADDRESS: PO Box 1, Durban, 4000

Sun International Ltd. 22.82% MORE INFO: www.sharedata.co.za/sdo/jse/GND

GPI Management Services (Pty) Ltd. 5.11% COMPANY SECRETARY: Vicky Commaille

POSTAL ADDRESS: PO Box 6563, Roggebaai, 8012 TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/GPL SPONSORS: Nedbank Corporate and Investment Banking, a division of

COMPANY SECRETARY: Statucor (Pty) Ltd. Nedbank Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: Deloitte & Touche Inc.

SPONSOR: PSG Capital (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: Moore Cape Town Inc.

GND Ords 0.002c ea 2 750 000 000 698 031 586

CAPITAL STRUCTURE AUTHORISED ISSUED GNDP Prefs 0.031c ea 20 000 000 7 400 000

GPL Ords 0.025c ea 2 000 000 000 470 022 741

DISTRIBUTIONS [ZARc]

DISTRIBUTIONS [ZARc] Ords 0.002c ea Ldt Pay Amt

Ords 0.025c ea Ldt Pay Amt Final No 34 2 Apr 24 8 Apr 24 38.00

Final No 12 5 Dec 23 11 Dec 23 10.00 Interim No 33 19 Sep 23 26 Sep 23 34.40

Final No 11 29 Nov 22 5 Dec 22 12.00

LIQUIDITY: Jul24 Avg 6m shares p.w., R71.7m(45.8% p.a.)

LIQUIDITY: Jul24 Avg 158 076 shares p.w., R494 879.8(1.7% p.a.)

INDT 40 Week MA GRINDROD

GENF 40 Week MA GRANPRADE

368

1315

327

1060

286

804

245

549

204

294

2019 | 2020 | 2021 | 2022 | 2023 | 2024

163

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS

NOTES: Grand Parade Investments Ltd. historical prices were adjusted to (R million) Dec 23 Dec 22 Dec 21 Dec 20 Dec 19

reflecttheunbundlingofSpurCorporationLtd.shareson14June2022.

Final Final Final(rst) Final Final(rst)

FINANCIAL STATISTICS Revenue 4 846 5 884 3 417 3 751 3 834

(Amts in ZAR’000) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20 Op (Loss) Inc 531 619 446 - 193 35

Interim Final Final(rst) Final(rst) Final NetIntPd(Rcvd) - 21 77 135 210 142

Turnover 12 738 1 356 10 729 1 012 1 312 326 Minority Int - 2 - 3 30 - 47 -

Op Inc - 8 359 - 101 076 - 52 562 - 45 609 41 720 Att Inc 988 601 176 - 109 - 616

NetIntPd(Rcvd) - 2 884 - 163 4 590 15 325 71 655 TotCompIncLoss 1 490 920 639 - 281 - 631

Minority Int - - 35 411 159 - - 2 980 Fixed Ass 1 773 1 681 1 738 1 951 3 054

Att Inc 50 888 20 200 - 11 736 - 30 625 - 123 527 Inv & Loans 1 886 1 754 8 214 6 886 7 211

TotCompIncLoss 57 708 - 13 136 - 8 405 - 11 533 - 140 193 Tot Curr Ass 4 612 4 357 9 666 9 657 13 794

Fixed Ass 5 946 846 1 415 554 815 573 862 Ord SH Int 9 932 8 883 8 623 8 109 8 607

Inv & Loans 24 780 17 960 91 195 162 619 143 527 Minority Int - 54 - 62 - 45 - 150 - 72

Tot Curr Ass 108 106 107 764 198 537 324 507 329 010 LT Liab 2 348 1 818 2 306 1 837 2 934

Ord SH Int 1 090 113 1 075 774 1 140 901 1 710 243 1 719 347 Tot Curr Liab 2 346 2 827 14 267 13 808 16 255

Minority Int - - - - 34 612 - 32 980 PER SHARE STATISTICS (cents per share)

LT Liab 162 428 2 303 390 208 391 469 HEPS-C (ZARc) 151.70 111.50 75.10 - 24.80 - 22.40

Tot Curr Liab 21 836 33 944 75 635 420 144 390 136 DPS (ZARc) 72.40 39.40 20.10 - 19.20

NAV PS (ZARc) 1 368.00 1 211.00 1 176.00 1 075.00 1 146.00

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.14 0.85 1.09 1.20 0.96

HEPS-C (ZARc) 12.82 4.69 0.38 2.97 - 11.23 Price High 1 200 1 198 570 535 905

DPS (ZARc) - 10.00 12.00 - - Price Low 876 460 430 281 408

NAV PS (ZARc) 253.10 250.04 265.34 398.19 402.73 Price Prd End 1 146 1 000 495 505 503

3 Yr Beta - 0.05 0.24 0.42 0.20 0.03 RATIOS

Price High 340 361 351 272 333 Ret on SH Fnd 9.98 6.78 2.39 - 1.97 - 7.22

Price Low 250 185 180 150 167 Oper Pft Mgn 10.97 10.52 13.06 - 5.14 0.91

Price Prd End 315 297 200 241 208 D:E 0.28 0.29 0.49 0.57 0.53

RATIOS Current Ratio 1.97 1.54 0.68 0.70 0.85

Ret on SH Fnd 9.34 - 1.35 - 0.93 - 1.69 - 6.76 Div Cover 2.04 2.29 1.30 - - 4.71

Oper Pft Mgn - 65.62 - 7 453.98 - 489.91 - 4 506.82 3.18

D:E - - 0.03 0.29 0.28

Current Ratio 4.95 3.17 2.62 0.77 0.84

Div Cover - - 0.35 - 0.23 - -

120