Page 48 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 48

CTSE - TRA Profile’s Stock Exchange Handbook: 2025 - Issue 3

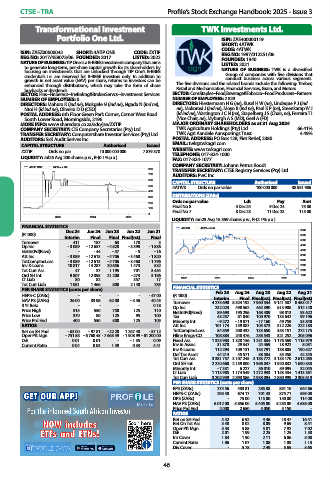

Transformational Investment TWK Investments Ltd.

Portfolio One Ltd. ISIN: ZAE400000119

SHORT: 4ATWK

CODE: 4ATWK

ISIN: ZAEZ00000042 SHORT: 4ATIP ONE CODE: ZXTIP REG NO: 1997/012251/06

REG NO: 2017/458073/06 FOUNDED: 2017 LISTED: 2022 FOUNDED: 1940

NATURE OF BUSINESS: TIP One is a B-BBEE investment company that aims

to generate long-term, per-share capital growth for its shareholders by LISTED: 2021

NATURE OF BUSINESS: TWK is a diversified

focusing on investments that are unlocked through TIP One’s B-BBEE

credentials i.e. are reserved for B-BBEE investors only. In addition to Group of companies with five divisions that

conduct business across various segments.

growth in net asset value (NAV) per share, returns to investors can be

enhanced through distributions, which may take the form of share The five divisions and the related brands include the following: Timber,

buybacks or dividends. Retail and Mechanisation, Financial Services, Grain, and Motors.

SECTOR: Fins--FinServcs--InvBnkng&BrokerServcs--Investment Services SECTOR: ConsStaples--Food,Beverage&Tobacco--Food Producers--Farmers

NUMBER OF EMPLOYEES: 0 NUMBER OF EMPLOYEES: 2 829

DIRECTORS: Mahura K (ind ne), Mokgele N (ind ne), Ngada N (ind ne), DIRECTORS: Hiestermann H G (ne), Kusel H W (ne), Lindeque P J (ind

Ntoi H (ld ind ne), Oliveira D D (CEO) ne), Mokorosi J (ind ne), Moyo B (ind ne), Paul K P (ne), Steenkamp W J

POSTAL ADDRESS: 6th Floor Green Park Corner, Corner West Road (ld ind ne), Wartington J C N (ne), Stapelberg J S (Chair, ne), Ferreira T I

South Lower Road, Morningside, 2196 (Vice Chair, ne), Myburgh A S (MD), Geel A (FD)

MORE INFO: www.sharedata.co.za/sdo/jse/ZXTIP MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2024

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. TWK Agriculture Holdings (Pty) Ltd. 66.41%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TWK Agri Aandele Aansporings Trust 4.49%

AUDITORS: SxK Audit Serives Inc. POSTAL ADDRESS: PO Box 128, Piet Retief, 2380

CAPITAL STRUCTURE Authorised Issued EMAIL: twk@twkagri.com

ZXTIP Ords no par 10 000 000 000 7 879 370 WEBSITE: www.twkagri.com

LIQUIDITY: Jul25 Avg 200 shares p.w., R-(0.1% p.a.) TELEPHONE: 017-824-1000

FAX: 017-824-1077

COMPANY SECRETARY: Johann Petrus Roodt

4ATIP ONE 40 Week MA

800 TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

AUDITORS: PwC Inc.

700

600

CAPITAL STRUCTURE Authorised Issued

500

4ATWK Ords no par value 100 000 000 38 951 986

400

DISTRIBUTIONS [ZARc]

300

Ords no par value Ldt Pay Amt

200

Final No 8 3 Dec 24 9 Dec 24 75.00

100

Final No 7 8 Dec 23 11 Dec 23 115.00

0

2023 2024 2025

LIQUIDITY: Jun25 Avg 15 359 shares p.w., R-(2.1% p.a.)

FINANCIAL STATISTICS 4ATWK 40 Week MA 6000

(R ’000) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 5500

Interim Final Final Final(rst) Final

Turnover 411 187 63 178 3 5000

Op Inc - 3 089 - 12 657 - 4 828 - 3 398 - 1 836 4500

NetIntPd(Rcvd) - - 44 - 47 - 5 - 16 4000

Att Inc - 3 089 - 12 613 - 4 706 - 3 460 - 1 820 3500

TotCompIncLoss - 3 089 - 12 613 - 4 706 - 3 460 - 1 796 3000

Inv & Loans 10 817 14 287 20 656 1 473 532 2500

Tot Curr Ass 47 37 1 195 701 3 454 2000

Ord SH Int 9 807 12 895 21 200 - 273 3 186 1500

LT Liab 80 82 - 357 17 2022 2023 2024 2025

Tot Curr Liab 1 081 1 466 800 2 140 783 FINANCIAL STATISTICS

PER SHARE STATISTICS (cents per share) Feb 25 Aug 24 Aug 23 Aug 22 Aug 21

HEPS-C (ZARc) - - - - - 47.00 (R ’000)

Interim

Final Final(rst) Final(rst) Final(rst)

NAV PS (ZARc) 26.00 33.98 62.00 - 3.46 40.43 Turnover 4 275 690 8 524 192 7 960 534 9 141 587 8 453 017

3 Yr Beta - - - - 0.18 Op Inc 232 023 498 562 462 390 613 908 512 140

Price High 515 550 750 125 110 NetIntPd(Rcvd) 89 693 195 296 168 409 98 013 93 622

Price Low 370 80 125 95 100 Tax 43 257 81 040 100 970 133 642 99 196

Price Prd End 400 550 500 125 105 Minority Int - 9 272 - 19 871 - 17 160 49 759 33 840

RATIOS Att Inc 101 174 159 887 105 373 312 226 222 183

Ret on SH Fnd - 63.00 - 97.81 - 22.20 1 267.40 - 57.12 TotCompIncLoss 84 859 200 432 133 650 353 151 272 175

Oper Pft Mgn - 751.58 - 6 768.45 - 7 663.49 - 1 908.99 - 61 200.00 Hline Erngs-CO 108 884 248 476 258 543 321 252 205 096

D:E 0.01 0.01 - - 1.35 0.09 Fixed Ass 1 325 983 1 328 156 1 251 834 1 176 569 1 115 979

Current Ratio 0.04 0.03 1.49 0.33 4.41 Inv in Assoc 31 870 29 347 24 469 18 922 8 031

Inv & Loans 112 294 109 131 133 791 138 805 190 527

Def Tax Asset 44 214 45 571 58 584 35 458 42 345

Tot Curr Ass 3 381 757 3 107 245 3 183 772 3 133 170 2 612 265

Ord SH Int 2 220 660 2 159 800 1 986 047 1 920 832 1 690 533

Minority Int - 7 331 6 227 36 010 59 095 32 045

LT Liab 1 113 985 1 174 549 1 272 933 1 153 434 1 413 361

Tot Curr Liab 3 202 939 2 893 586 2 938 094 2 880 999 2 305 619

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 274.56 433.81 285.88 851.10 644.66

HEPS-C (ZARc) 295.48 674.17 701.43 875.71 595.08

DPS (ZARc) - 75.00 115.00 150.00 114.00

NAV PS (ZARc) 6 012.00 5 856.00 5 405.00 5 255.00 4 636.00

Price Prd End 2 000 2 650 5 050 5 150 -

RATIOS

Ret on SH Fnd 4.42 6.92 4.46 18.47 16.41

Ret On Tot Ass 3.48 8.02 8.09 9.69 8.41

Oper Pft Mgn 5.33 5.85 5.81 7.92 7.02

D:E 2.01 1.99 2.25 1.25 1.58

Int Cover 1.84 1.90 2.11 6.06 5.08

Current Ratio 1.06 1.07 1.08 1.09 1.13

Div Cover - 5.78 2.49 5.69 5.65

46