Page 44 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 44

CTSE - ARB Profile’s Stock Exchange Handbook: 2025 - Issue 3

Arbitrage Holdings Ltd. BKB Ltd.

ISIN: ZAE400000267 SHORT: ARBITRAGE CODE: 4AARB ISIN: ZAE400000069 SHORT: BKB CODE: 4ABKB

REG NO: 24/ 2021/732583/06 FOUNDED: 2021 LISTED: 2024 REG NO: 1998/012435/06 FOUNDED: 1998 LISTED: 2022

NATURE OF BUSINESS: Arbitrage Holdings is dedicated to shaping the NATURE OF BUSINESS: BKB was established in 1998 as the ultimate

future of energy. As a premier energy and mining company, Arbitrage holding Company of the BKB Group of Companies, which is a leading

Holdings manages a diverse portfolio encompassing both traditional player in the South African agricultural industry. The BKB Group operates

coal assets and pioneering renewable energy projects directly in multiple agricultural sectors across all 9 (nine) provinces in

SECTOR: Energy--Energy--OilGas&Coal--Coal South Africa as well as in eSwatini and the Kingdom of Lesotho.

NUMBER OF EMPLOYEES: 0 SECTOR: ConsStaples--Food,Beverage&Tobacco--Food Producers--Farmers

DIRECTORS: Ntseare T M (ind ne), Rautenbach I (ld ind ne), NUMBER OF EMPLOYEES: 0

Seoloane K (ind ne), Tlale C K, Kotze C (Chair, ind ne), Swart R (CEO), DIRECTORS: du Toit A S, Fick C (ind ne), Hobson C D (ind ne),

de Jager P C (CFO) Janse Van Rensburg J F (ind ne), Louw J G (ind ne), Staple H C (ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 9 Dec 2024 Zondi T P (ind ne), Stumpf J E (MD), van Niekerk J A (CFO)

NIO Capital 27.50% MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

Afri Goal 27.12% VKB Beleggings (Pty) Ltd. 30.25%

AT CMS 9.23% BKB Beperk Personeel Aandeletrust 11.60%

POSTAL ADDRESS: 40 Oxford Street, Durbanville, 7550 The BKB Empowerment Trust (Ciskei) 5.50%

MORE INFO: www.sharedata.co.za/sdo/jse/4AARB POSTAL ADDRESS: PO Box 2002, North End, Gqeberha, 6056

COMPANY SECRETARY: Poloko Dikgole MORE INFO: www.sharedata.co.za/sdo/jse/4ABKB

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd. COMPANY SECRETARY: Johannette Oosthuizen

AUDITORS: Louis Jonker Chartered Accountants TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

CAPITAL STRUCTURE Authorised Issued AUDITORS: PwC Inc.

4AARB Ords no par value 1 000 000 000 696 934 809 CAPITAL STRUCTURE Authorised Issued

LIQUIDITY: Jul25 Avg 2 388 shares p.w., R1 609.2(-% p.a.) 4ABKB Ords no par value 200 000 000 88 407 075

DISTRIBUTIONS [ZARc]

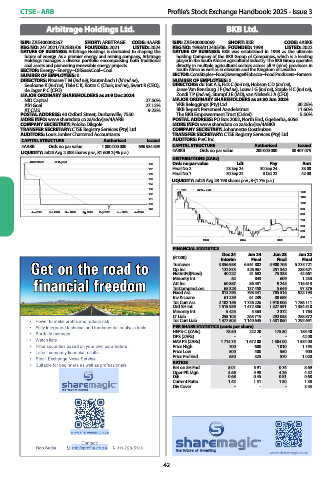

ARBITRAGE 80 Day MA Ords no par value Ldt Pay Amt

158

157 Final No 2 23 Sep 24 30 Sep 24 33.00

156 Final No 1 30 Sep 22 3 Oct 22 42.00

155 LIQUIDITY: Jul25 Avg 28 198 shares p.w., R-(1.7% p.a.)

154

153 BKB 40 Week MA

1200

152

1100

151

1000

150

900

149

Jan 2025 Feb 2025 Mar 2025 Apr 2025 May 2025 Jun 2025 Jul 2025

800

700

600

500

400

2023 2024 2025

FINANCIAL STATISTICS

(R ‘000) Dec 24 Jun 24 Jun 23 Jun 22

Interim Final Final Final

Turnover 3 356 958 6 561 802 5 900 706 5 275 721

Op Inc 122 873 326 967 251 340 238 621

NetIntPd(Rcvd) 40 222 81 682 75 338 42 661

Minority Int 62 843 609 1 233

Att Inc 60 887 86 431 9 245 116 613

TotCompIncLoss 65 328 137 458 5 649 97 376

Fixed Ass 813 295 798 541 785 516 922 193

Inv & Loans 61 239 61 239 38 689 -

Tot Curr Ass 2 102 156 1 726 226 1 918 006 1 786 111

Ord SH Int 1 515 959 1 472 386 1 327 591 1 354 510

Minority Int 5 425 5 363 2 372 1 763

LT Liab 255 103 265 715 292 058 288 872

Tot Curr Liab 1 477 503 1 140 645 1 481 060 1 292 691

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 78.50 222.20 175.80 158.40

DPS (ZARc) - - - 42.00

NAV PS (ZARc) 1 714.75 1 672.00 1 504.00 1 534.00

Price High 700 600 1 010 1 195

Price Low 500 400 550 900

Price Prd End 630 525 570 1 020

RATIOS

Ret on SH Fnd 8.01 5.91 0.74 8.69

Oper Pft Mgn 3.66 4.98 4.26 4.52

D:E 0.68 0.45 0.81 0.68

Current Ratio 1.42 1.51 1.30 1.38

Div Cover - - - 3.53

42