Page 22 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 22

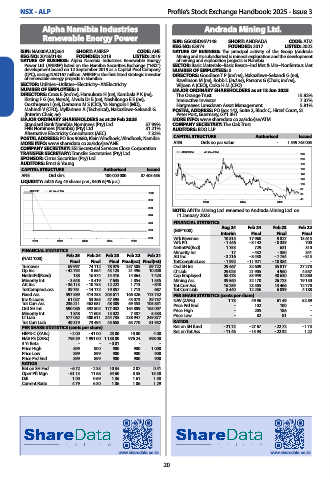

NSX - ALP Profile’s Stock Exchange Handbook: 2025 - Issue 3

Alpha Namibia Industries Andrada Mining Ltd.

Renewable Energy Power ISIN: GG00BD95V148 SHORT: ANDRADA CODE: ATM

REG NO: 63974 FOUNDED: 2017 LISTED: 2022

ISIN: NA000A2JQ364 SHORT: ANIREP CODE: ANE NATURE OF BUSINESS: The principal activity of the Group (Andrada

REG NO: 2018/0148 FOUNDED: 2018 LISTED: 2019 Mining and its subsidiaries) is mineral exploration and the development

NATURE OF BUSINESS: Alpha Namibia Industries Renewable Energy of mining and exploration projects in Namibia.

Power Ltd. (ANIREP) listed on the Namibia Securities Exchange (“NSX”) SECTOR: Basic Materials--Basic Resrcs--Ind Met & Min--Nonferrous Met

development board on 12 September 2019 as a Capital Pool Company NUMBER OF EMPLOYEES: 0

(CPC), raising NAD167 million. ANIREP is the first listed strategic investor DIRECTORS: Goodlace T P (ind ne), Nakazibwe-Sekandi G (ne),

of renewable energy projects in Namibia. Rawlinson M (ne), Robb L (ind ne), Parsons G (Chair, ind ne),

SECTOR: Utilities--Utilities--Electricity--AltElectricity Viljoen A (CEO), Ooka H M (CFO)

NUMBER OF EMPLOYEES: 0 MAJOR ORDINARY SHAREHOLDERS as at 13 Jun 2025

DIRECTORS: Cross E (ind ne), Hamukoto H (ne), Kambala P K (ne), The Orange Trust 15.82%

Kisting F G (ne, Namb), Mvula Dr E (ne), Nashilongo E E (ne), Interactive Investor 7.37%

Oosthuysen I (ne), Demamu M S (CIO), Ya Nangolo I (MD), Hargreaves Lansdown Asset Management 5.81%

Mahindi V (CFO), Myllärinen A (Technical), Nakazibwe-Sekandi G POSTAL ADDRESS: PO Box 142, Suite 2, Block C, Hirzel Court, St.

(Interim Chair, ne) Peter Port, Guernsey, GY1 3HT

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2025 MORE INFO: www.sharedata.co.za/sdo/jse/ATM

Standard Bank Namibia Nominees (Pty) Ltd. 57.99% COMPANY SECRETARY: The Oak Trust

FNB Nominees (Nambia) (Pty) Ltd. 31.21% AUDITORS: BDO LLP

Alternative Electricity Consultants (AEC) 7.32% CAPITAL STRUCTURE Authorised Issued

POSTAL ADDRESS: PO Box 90680, Klein Windhoek, Windhoek, Namibia

MORE INFO: www.sharedata.co.za/sdo/jse/ANE ATM Ords no par value - 1 549 745 003

COMPANY SECRETARY: ESI Secretarial Services Close Corporation

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. ANDRADA 40 Week MA 220

SPONSOR: Cirrus Securities (Pty) Ltd. 200

AUDITORS: Ernst & Young 180

CAPITAL STRUCTURE Authorised Issued 160

ANE Ord shrs 100 000 000 87 405 656 140

120

LIQUIDITY: Jul25 Avg 45 shares p.w., R405.6(-% p.a.)

100

80

ANIREP 40 Week MA

1000 60

980 40

2023 2024 2025

960

NOTE: AfriTin Mining Ltd. renamed to Andrada Mining Ltd. on

940 11 January 2023.

920 FINANCIAL STATISTICS

Aug 24 Feb 24 Feb 23 Feb 22

900 (GBP ‘000) Interim Final Final Final

880 Wrk Revenue 10 815 17 968 9 827 13 615

2021 2022 2023 2024 2025 Wrk Pft - 1 446 - 8 142 - 8 339 700

NetIntPd(Rcd) 1 753 729 631 310

FINANCIAL STATISTICS Minority Int 17 - 432 - 350 341

Feb 25 Feb 24 Feb 23 Feb 22 Feb 21 Att Inc - 3 216 - 8 438 - 7 754 - 815

(NAD ’000)

Final Final Final Final(rst) Final(rst) TotCompIncLoss - 1 992 - 11 921 - 10 384 -

Turnover 69 997 74 112 78 979 257 505 69 722 Ord SH Int 29 467 32 609 35 817 27 278

Op Inc - 42 792 8 654 43 125 21 496 10 808 LT Liab 29 025 21 905 4 960 4 557

NetIntPd(Rcvd) 138 16 574 14 416 14 864 7 423 Cap Employed 58 478 53 959 40 630 32 880

Minority Int - 3 648 - 3 419 7 635 1 854 1 535 Mining Ass 39 560 32 170 26 723 19 150

Att Inc - 36 113 - 10 753 12 222 1 713 - 848 Tot Curr Ass 16 259 23 505 13 466 12 770

TotCompIncLoss 39 761 - 14 172 19 857 1 713 687 Tot Curr Liab 8 440 12 236 6 839 4 188

Fixed Ass 597 589 414 253 205 611 166 326 173 752 PER SHARE STATISTICS (cents per share)

Inv & Loans 61 027 53 363 47 395 43 073 39 757 NAV (ZARc) 1.78 49.96 61.49 52.89

Tot Curr Ass 236 211 462 681 48 309 69 553 105 851 Price Prd End - 102 100 -

Ord SH Int 590 086 592 502 177 032 164 809 163 097 Price High - 205 186 -

Minority Int 1 848 11 603 15 022 7 387 5 533 Price Low - 82 81 -

LT Liab 577 062 400 611 244 735 238 947 249 877

Tot Curr Liab 49 319 73 494 45 658 65 770 81 932 RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH fund - 21.72 - 27.67 - 22.72 - 1.73

- 22.32

- 15.93

Ret on Tot Ass

1.22

- 11.46

HEPS-C (ZARc) - 2.00 - 41.00 25.00 10.00 4.00

NAV PS (ZARc) 795.39 1 991.00 1 138.00 976.24 998.00

3 Yr Beta - - - 0.01 - -

Price High 899 900 900 900 1 000

Price Low 899 899 900 900 900

Price Prd End 899 899 900 900 900

RATIOS

Ret on SH Fnd - 6.72 - 2.35 10.34 2.07 0.41

Oper Pft Mgn - 61.13 11.68 54.60 8.35 15.50

D:E 1.00 0.69 1.36 1.61 1.58

Current Ratio 4.79 6.30 1.06 1.06 1.29

www.sharedata.co.za www.sharedata.co.za

20