Page 47 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 47

Profile’s Stock Exchange Handbook: 2025 – Issue 2 CTSE – 4ANWKH

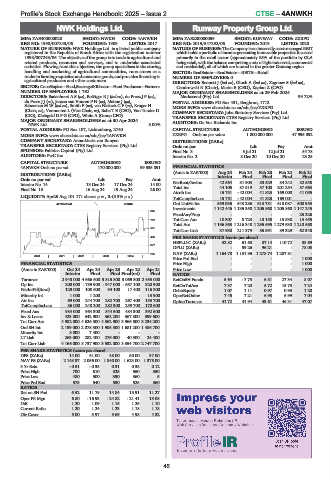

NWK Holdings Ltd. Runway Property Group Ltd.

4ANWKH ZXRPG

ISIN: ZAE400000028 SHORT: NWKH CODE: 4ANWKH ISIN: ZAEZ00000059 SHORT: RUNWAY CODE: ZXRPG

REG NO: 1998/007243/06 FOUNDED: 1909 LISTED: 2017 REG NO: 2019/547292/06 FOUNDED: 2019 LISTED: 2020

NATURE OF BUSINESS: NWK Holdings Ltd. is a listed public company NATURE OF BUSINESS: The Company is an internally asset-managed REIT

registered in the Republic of South Africa with the registration number which holds a portfolio of income-generating immovable properties focussed

1998/007243/06. The objective of the group is to trade in agricultural and primarily in the retail sector (approximately 85% of the portfolio by GLA

related products, resources and services, and to undertake associated being retail, with the balance comprising amixoflightindustrial, commercial

activities. Flowing from this objective, the group specialises in the storing, and residential), all of which are located in the greater Gauteng region.

handling and marketing of agricultural commodities, runs stores as a SECTOR: RealEstate—RealEstate—REITS—Retail

traderinfarmingrequisites andconsumergoods,andprovidesfinancingto NUMBER OF EMPLOYEES: 0

agricultural producers and other customers. DIRECTORS: Bennett J (ind ne), Gluch A (ind ne), Zagnoev S (ind ne),

SECTOR: ConsStaples—Food,Beverage&Tobacco—Food Producers—Farmers Cendrowski R (Chair), Marks E (CEO), Kaplan Z (CFO)

NUMBER OF EMPLOYEES: 1 762 MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

DIRECTORS: Badenhorst A S (ne), Boëttger R J (ind ne), du Preez J P (ne), Markscend (Pty) Ltd. 99.72%

du PreezJJ(ne), Jansen van Vuuren P N (ne), Mahne J (ne), POSTAL ADDRESS: PO Box 431, Bergbron, 1712

Schoeman M W (ind ne), Smith F (ne), van Niekerk C F (ne), Kruger H MORE INFO: www.sharedata.co.za/sdo/jse/ZXRPG

(Chair, ne), Vermooten L (Vice Chair, ne), Rabe T E (CEO), Van Tonder D COMPANY SECRETARY: Juba Statutory Services (Pty) Ltd.

(CIO), Kleingeld D P G (CFO), White A (Group CFO) TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 30 Apr 2024 AUDITORS: De Vos Richards Inc.

NWK Ltd. 8.00%

POSTAL ADDRESS: PO Box 107, Lichtenburg, 2740 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/4ANWKH ZXRPG Ords no par value 1 000 000 000 47 995 092

COMPANY SECRETARY: Anna-Marie van Rooyen DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd. Ords no par Ldt Pay Amt

SPONSOR: Pallidus Capital (Pty) Ltd. Final No 3 5 Jul 21 12 Jul 21 54.78

AUDITORS: PwC Inc. Interim No 2 8 Dec 20 10 Dec 20 23.25

CAPITAL STRUCTURE AUTHORISED ISSUED

4ANWKH Ords no par val 170 000 000 99 535 891 FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21

DISTRIBUTIONS [ZARc] Interim Final Final Final Final

Ords no par val Ldt Pay Amt NetRent/InvInc 42 564 81 903 83 529 84 242 82 558

Interim No 14 13 Dec 24 17 Dec 24 14.00

Final No 13 16 Aug 24 19 Aug 24 26.00 Total Inc 44 105 87 519 87 100 201 254 87 663

Attrib Inc 15 751 - 42 004 41 823 169 000 41 055

LIQUIDITY: Apr25 Avg 101 171 shares p.w., R-(5.3% p.a.) TotCompIncLoss 15 751 - 42 004 41 823 169 001 -

40 Week MA NWKH Ord UntHs Int 559 036 543 286 613 731 618 087 508 953

Investments 1 142 446 1 135 350 1 205 860 1 205 860 1 147 245

825

FixedAss/Prop - - - - 25 226

713 Tot Curr Ass 10 307 8 723 13 150 15 538 13 455

Total Ass 1 196 863 1 216 348 1 295 695 1 279 630 1 210 568

601

Tot Curr Liab 37 930 211 379 85 591 89 329 62 340

489 PER SHARE STATISTICS (cents per share)

HEPLU-C (ZARc) 32.82 61.68 87.14 110.72 88.69

377

DPLU (ZARc) - 59.26 96.21 - 78.03

265 NAV (ZARc) 1 164.78 1 131.96 1 278.74 1 287.81 -

2020 | 2021 | 2022 | 2023 | 2024 |

Price Prd End - - - - 1 000

FINANCIAL STATISTICS Price High - - - - 1 000

(Amts in ZAR’000) Oct 24 Apr 24 Apr 23 Apr 22 Apr 21 Price Low - - - - 1 000

Interim Final Final Final(rst) Final RATIOS

Turnover 2 943 000 4 666 600 3 815 800 3 069 300 2 453 000 RetOnSH Funds 5.64 - 7.73 6.81 27.34 8.07

Op Inc 200 000 - 789 900 - 947 000 - 657 100 320 900 RetOnTotAss 7.37 7.20 6.72 15.73 7.24

NetIntPd(Rcvd) 129 000 100 600 94 100 17 400 116 300 Debt:Equity 1.07 1.11 0.97 0.93 1.20

Minority Int 1 000 1 200 - - 13 900 OperRetOnInv 7.45 7.21 6.93 6.99 7.04

Att Inc 69 000 244 700 282 700 267 400 153 700 OpInc:Turnover 41.72 41.94 43.61 46.31 47.07

TotCompIncLoss 86 000 248 200 282 300 259 700 170 600

Fixed Ass 984 000 964 300 844 500 484 300 392 500

Inv & Loans 423 000 342 900 362 200 367 800 399 600

Tot Curr Ass 4 982 000 4 626 300 4 362 900 3 966 500 3 234 200

Ord SH Int 2 139 000 2 078 300 1 905 500 1 681 200 1 486 700

Minority Int 8 000 7 400 - - -

LT Liab 263 000 282 400 276 000 40 300 24 400

Tot Curr Liab 4 166 000 3 737 900 3 532 800 3 354 700 2 747 700

PER SHARE STATISTICS (cents per share)

DPS (ZARc) 14.00 61.00 48.00 50.00 37.00

NAV PS (ZARc) 2 148.97 2 056.00 1 840.00 1 623.00 1 375.00

3 Yr Beta - 0.51 - 0.35 0.31 0.38 0.12

Price High 700 610 825 550 550

Price Low 480 500 390 360 5

Price Prd End 575 540 530 525 360

RATIOS

Ret on SH Fnd 6.52 11.79 14.84 15.91 11.27

Oper Pft Mgn 6.80 - 16.93 - 24.82 - 21.41 13.08

D:E 1.20 1.09 1.15 1.25 1.10

Current Ratio 1.20 1.24 1.23 1.18 1.18

Div Cover 5.00 3.97 5.69 4.98 4.32

45