Page 46 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 46

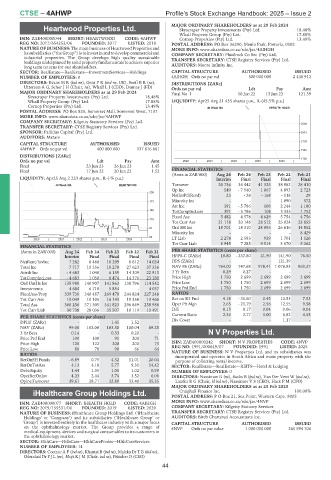

CTSE – 4AHWP Profile’s Stock Exchange Handbook: 2025 – Issue 2

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024

Heartwood Properties Ltd. Skyscraper Property Investments (Pty) Ltd. 18.48%

Whall Property Group (Pty) Ltd. 17.88%

4AHWP

ISIN: ZAE400000044 SHORT: HEARTWOOD CODE: 4AHWP Cornop Properties (Pty) Ltd. 13.49%

REG NO: 2017/654253/06 FOUNDED: 2017 LISTED: 2018 POSTAL ADDRESS: PO Box 36290, Menlo Park, Pretoria, 0102

NATURE OF BUSINESS: The main business of Heartwood Properties and MORE INFO: www.sharedata.co.za/sdo/jse/4AIHGH

itssubsidiaries (“theGroup”)istoinvestinandtodevelopcommercial and COMPANY SECRETARY: Fluidrock Co Sec (Pty) Ltd.

industrial properties. The Group develops high quality sustainable TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

buildings underpinned by solid property fundamentals to achieve superior

long term returns for our shareholders. AUDITORS: Moore Infinity Inc.

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings CAPITAL STRUCTURE AUTHORISED ISSUED

NUMBER OF EMPLOYEES: 0 4AIHGH Ords no par val 500 000 000 2 448 912

DIRECTORS: EvansMR(ind ne), GentPR(ind ne, UK), SeeffBR(ne), DISTRIBUTIONS [ZARc]

Utterson A G, Scher J H (Chair, ne), Whall L J (CEO), Dumas J (FD) Ords no par val Ldt Pay Amt

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024 Final No 1 10 Jun 22 13 Jun 22 121.39

Skyscraper Property Investments (Pty) Ltd. 18.48%

Whall Property Group (Pty) Ltd. 17.88% LIQUIDITY: Apr25 Avg 21 435 shares p.w., R-(45.5% p.a.)

Cornop Properties (Pty) Ltd. 13.49% 40 Week MA IHEALTH HOLD

POSTAL ADDRESS: PO Box 825, Somerset Mall, Somerset West, 7137

MORE INFO: www.sharedata.co.za/sdo/jse/4AHWP

COMPANY SECRETARY: Kilgetty Statutory Services (Pty) Ltd.

2509

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

SPONSOR: Pallidus Capital (Pty) Ltd. 2319

AUDITORS: Mazars

2130

CAPITAL STRUCTURE AUTHORISED ISSUED

4AHWP Ords no par val 400 000 000 137 616 861 1940

DISTRIBUTIONS [ZARc]

1750

Ords no par val Ldt Pay Amt 2020 | 2021 | 2022 | 2023 | 2024 |

Final 23 Jun 23 26 Jun 23 1.45

Final 17 Jun 22 20 Jun 22 1.52 FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21

LIQUIDITY: Apr25 Avg 2 223 shares p.w., R-(-% p.a.) Interim Final Final Final Final

40 Week MA HEARTWOOD Turnover 20 736 36 442 41 325 38 982 28 410

Op Inc 549 - 7 940 1 067 4 893 2 723

200

NetIntPd(Rcvd) 23 - 28 - 168 - 118 29

173 Minority Int - - - 1 090 572

Att Inc 391 - 5 786 108 2 244 1 180

146

TotCompIncLoss 391 - 5 786 108 3 335 1 752

Fixed Ass 5 482 4 578 4 629 5 754 4 756

118

Tot Curr Ass 21 118 20 148 28 512 25 024 23 855

91 Ord SH Int 18 701 18 310 24 096 26 616 14 852

Minority Int - - - - 8 429

64 LT Liab 2 274 2 585 939 1 701 1 026

2020 | 2021 | 2022 | 2023 | 2024 |

Tot Curr Liab 8 945 7 285 9 514 3 670 5 262

FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 24 Feb 24 Feb 23 Feb 22 Feb 21 PER SHARE STATISTICS (cents per share)

Interim Final Final Final Final HEPS-C (ZARc) 10.80 - 237.80 21.50 141.90 76.50

NetRent/InvInc 7 282 8 488 10 299 8 612 14 024 DPS (ZARc) - - - 121.39 -

Total Inc 7 717 10 356 18 270 27 623 37 336 NAV PS (ZARc) 764.00 747.68 978.41 1 076.93 963.27

Attrib Inc - 4 683 1 040 6 159 14 309 22 913 3 Yr Beta 0.29 0.27 - - -

TotCompIncLoss - 4 683 1 050 6 474 14 376 23 180 Price High 1 750 2 699 2 699 2 699 2 699

Ord UntHs Int 135 988 140 907 141 863 130 796 114 542 Price Low 1 750 1 750 2 699 2 699 2 699

Investments 4 684 6 710 5 854 - 4 037 Price Prd End 1 750 1 750 2 699 2 699 2 699

FixedAss/Prop 339 736 340 487 269 470 244 824 227 248 RATIOS

Tot Curr Ass 10 049 10 105 16 143 19 358 13 466 Ret on SH Fnd 4.18 - 31.60 0.45 12.53 7.53

Total Ass 368 256 371 305 341 823 296 869 258 988 Oper Pft Mgn 2.65 - 21.79 2.58 12.55 9.58

Tot Curr Liab 30 738 28 036 35 507 10 119 13 491 D:E 0.15 0.17 0.04 0.06 0.04

Current Ratio 2.36 2.77 3.00 6.82 4.53

PER SHARE STATISTICS (cents per share)

DPLU (ZARc) - - 1.45 1.52 - Div Cover - - - 1.17 -

NAV (ZARc) 99.00 102.00 103.30 100.04 89.25

3 Yr Beta 0.14 - 0.33 0.20 - N V Properties Ltd.

Price Prd End 100 100 91 200 71 4NVP

Price High 120 122 200 200 73 ISIN: ZAE400000242 SHORT: N V PROPERTIES CODE: 4NVP

Price Low 80 70 90 66 64 REG NO: 1991/000649/07 FOUNDED: 1991 LISTED: 2025

NATURE OF BUSINESS: N V Properties Ltd. and its subsidiaries was

RATIOS incorporated and operates in South Africa and owns property with the

RetOnSH Funds - 6.89 0.75 4.32 11.01 20.04 purpose of collecting rental income.

RetOnTotAss 4.13 4.18 5.77 9.31 14.42 SECTOR: RealEstate—RealEstate—REITS—Hotel & Lodging

Debt:Equity 1.44 1.35 1.05 1.02 0.99 NUMBER OF EMPLOYEES: 0

OperRetOnInv 4.23 2.44 3.74 3.52 6.06 DIRECTORS: Nassimov R (ne), Sacks B (ind ne), Van Der Vent W (ind ne),

OpInc:Turnover 39.61 28.71 32.88 33.40 35.35 Lander R G (Chair, ld ind ne), NassimovVS(CEO),HackPM(CFO)

MAJOR ORDINARY SHAREHOLDERS as at 25 Feb 2025

iHealthcare Group Holdings Ltd. Craighall Finance Inc. 100.00%

POSTAL ADDRESS: P O Box 21, Sea Point, Western Cape, 8005

4AIHGH MORE INFO: www.sharedata.co.za/sdo/jse/4NVP

ISIN: ZAE400000077 SHORT: IHEALTH HOLD CODE: 4AIHGH

REG NO: 2019/155531/06 FOUNDED: 2019 LISTED: 2020 COMPANY SECRETARY: Kilgetty Statuory Services

NATURE OF BUSINESS: iHealthcare Group Holdings Ltd. (‘iHealthcare TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

Holdings’ or ‘Company’) and its subsidiaries (‘iHealthcare Group’ or AUDITORS: Birch Chartered Accountants Inc.

‘Group’) is invested entirely in the healthcare industry with a major focus CAPITAL STRUCTURE AUTHORISED ISSUED

on the ophthalmology market. The Group provides a range of 4NVP Ords no par value 1 000 000 000 265 594 706

medical-equipment, devices and surgical consumables to its customers in

the ophthalmology market.

SECTOR: HlthCare—HtlhCare—HlthCarePrvdrs—HlthCareServices

NUMBER OF EMPLOYEES: 14

DIRECTORS: Coetzee A P (ind ne), Khantsi B (ind ne), Maleka Dr T B (ind ne),

Odendaal Dr P J L (ne), Moja K J M (Chair, ind ne), Prinsloo D (CEO)

44