Page 31 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 31

Profile’s Stock Exchange Handbook: 2025 – Issue 2 NSX – PNH

Paratus Namibia Holdings Ltd. Reconnaissance Energy Africa Ltd.

PNH REC

ISIN: NA000A2DTQ42 SHORT: PARATUS NM CODE: PNH ISIN: CA75624R1082 SHORT: RECON CODE: REC

REG NO: 2017/0558 FOUNDED: 2017 LISTED: 2017 REG NO: BC0177035 FOUNDED: 2024 LISTED: 2024

NATURE OF BUSINESS: Paratus Namibia Holdings Ltd. (“PNH”) was NATURE OF BUSINESS: ReconAfrica is a Canadian-based oil and gas

incorporated in Namibia and operates principally in Namibia as an company working collaboratively with national governments to explore

investment holding company. Its subsidiaries operate in the property the potential for oil and gas resources in Northeast Namibia on Petroleum

holding and Information and Communications Technology (“ICT”) Exploration Licence 073 (“PEL 73") and Northwest Botswana on

industries and are fast expanding into the Digital Service Provider industry. Petroleum Exploration Licence 001 (”PEL 001").

All its subsidiaries operate principally in Namibia. SECTOR: Energy—Energy—OilGas&Coal—IntegratedOil&Gas

SECTOR: Telecoms—Telecoms—TelecomServiceProvider—TelecomServices NUMBER OF EMPLOYEES: 0

NUMBER OF EMPLOYEES: 195 DIRECTORS: Aylesworth D W, Davis Dr J R, Harder Dr J, Hill I,

DIRECTORS: Duvenhage G P J (alt), Graig R (ind ne), Harmse B R J (Exec McQueen D (Chair), Reinsborough B (CEO), Escribano C (CFO)

Chair, Namb), Jansen van Vuuren H (ne), Mendelsohn RPK(alt, Namb), POSTAL ADDRESS: PO Box 518, Rundu, Namibia

MostertMR(ne, Namb), Shikongo J N N (ind ne, Namb), van de Merwe I D J MORE INFO: www.sharedata.co.za/sdo/jse/REC

(ne), HallA(MD, Namb), COMPANY SECRETARY:

de Bruin S (CFO, Namb), Erasmus S L V (Group CEO, Namb)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 CAPITAL STRUCTURE AUTHORISED ISSUED

Paratus Group Holdings Ltd. 53.81% REC Cmn shrs - 264 787 771

Government Institutions Pension Fund 17.70%

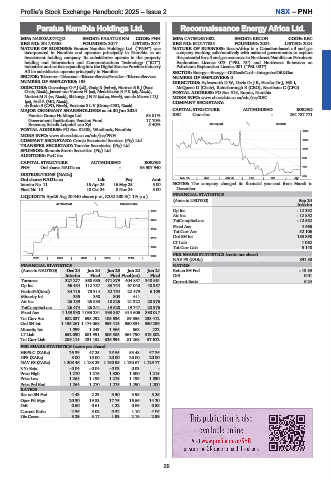

Erasmus, Schalk Leipoldt van Zyl 5.40% 80 Day MA RECON

POSTAL ADDRESS: PO Box 81588, Windhoek, Namibia 1595

MORE INFO: www.sharedata.co.za/sdo/jse/PNH

COMPANY SECRETARY: Cronje Secretarial Services (Pty) Ltd. 1393

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

1191

SPONSOR: Simonis Storm Securities (Pty) Ltd.

AUDITORS: PwC Inc.

989

CAPITAL STRUCTURE AUTHORISED ISSUED

PNH Ord shares NAD1c ea - 98 907 940 787

DISTRIBUTIONS [NADc] 585

Nov 24 | Dec | Jan 25 | Feb | Mar | Apr

Ord shares NAD1c ea Ldt Pay Amt

Interim No 11 16 Apr 25 16 May 25 5.00 NOTES: The company changed its financial year-end from March to

Final No 10 18 Oct 24 8 Nov 24 5.00 December.

FINANCIAL STATISTICS

LIQUIDITY: Apr25 Avg 20 340 shares p.w., R252 300.3(1.1% p.a.)

(Amts in USD’000) Sep 24

40 Week MA PARATUS NM Interim

1320 Op Inc - 12 332

AttInc -12852

1256 TotCompIncLoss - 12 582

Fixed Ass 4 666

1192

Tot Curr Ass 32 106

Ord SH Int 185 898

1128

LT Liab 1 062

1064 Tot Curr Liab 5 148

PER SHARE STATISTICS (cents per share)

1000

2020 | 2021 | 2022 | 2023 | 2024 |

NAV PS (ZARc) 891.80

FINANCIAL STATISTICS RATIOS

(Amts in NAD’000) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 Ret on SH Fnd - 13.83

Interim Final Final Final(rst) Final D:E 0.01

Turnover 327 277 568 685 471 879 404 857 340 561 Current Ratio 6.24

Op Inc 66 434 112 757 83 744 67 040 48 357

NetIntPd(Rcvd) 34 715 73 314 52 754 22 479 6 109

Minority Int 335 358 803 411 -

Att Inc 26 139 25 883 18 826 21 322 28 976

TotCompIncLoss 26 474 26 241 19 628 19 747 28 976

Fixed Ass 1 159 330 1 093 231 993 867 614 606 390 017

Tot Curr Ass 682 837 698 292 105 536 89 355 233 412

Ord SH Int 1 195 261 1 174 068 559 415 550 334 550 236

Minority Int 1 099 1 243 1 365 562 222

LT Liab 652 090 681 991 505 585 364 790 313 802

Tot Curr Liab 289 114 231 152 326 994 81 268 57 672

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 26.39 47.25 38.55 53.48 57.86

DPS (ZARc) 5.00 15.00 20.00 20.00 20.00

NAV PS (ZARc) 1 208.46 1 188.29 1 150.95 1 130.67 1 129.77

3 Yr Beta - 0.04 - 0.04 - 0.03 0.03 -

Price High 1 270 1 275 1 320 1 300 1 215

Price Low 1 264 1 199 1 275 1 199 1 090

Price Prd End 1 264 1 270 1 275 1 290 1 200

RATIOS

Ret on SH Fnd 4.43 2.23 3.50 3.95 5.26

Oper Pft Mgn 20.30 19.83 17.75 16.56 14.20

D:E 0.60 0.61 1.22 0.69 0.58

Current Ratio 2.36 3.02 0.32 1.10 4.05

Div Cover 5.29 3.17 1.93 2.19 2.99

29