Page 23 - Profile's Stock Exchange Handbook - 2025 Issue 2

P. 23

Profile’s Stock Exchange Handbook: 2025 – Issue 2 NSX – B2G

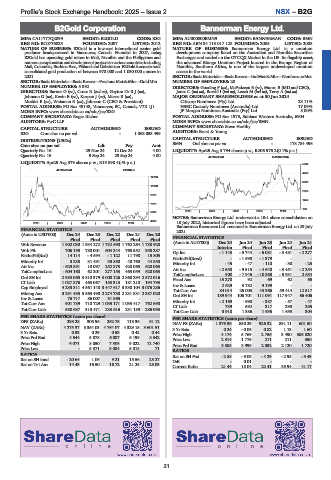

B2Gold Corporation Bannerman Energy Ltd.

B2G BMN

ISIN: CA11777Q2099 SHORT: B2GOLD CODE: B2G ISIN: AU000000BMN9 SHORT: BANNERMAN CODE: BMN

REG NO: BC0776025 FOUNDED: 2007 LISTED: 2012 REG NO: ABN 34 113 017 128 FOUNDED: 2005 LISTED: 2008

NATURE OF BUSINESS: B2Gold is a low-cost international senior gold NATURE OF BUSINESS: Bannerman Energy Ltd. is a uranium

producer headquartered in Vancouver, Canada. Founded in 2007, today, development company listed on the Australian and Namibia Securities

B2Gold has operating gold mines in Mali, Namibia and the Philippines and Exchanges and traded on the OTCQX Market in the US. Its flagship asset,

numerousexplorationanddevelopmentprojectsinvariouscountriesincluding the advanced Etango Uranium Project located in the Erongo Region of

Mali, Colombia, Burkina Faso, Finland and Uzbekistan. B2Gold forecasts total Namibia, Southern Africa, is one of the largest undeveloped uranium

consolidated gold production of between 970 000 and 1 030 000 ounces in assets in the world.

2021. SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—NonferrousMet

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin NUMBER OF EMPLOYEES: 20

NUMBER OF EMPLOYEES: 5 392 DIRECTORS: Gooding F (ne), McFadzean B (ne), Munro B (MD and CEO),

DIRECTORS: Barnes G (ne), Cross R (ind ne), Gayton DrRJ(ne), Jones C (ind ne), Burvill I (ind ne), Leech M (ind ne), Terry A (ind ne)

Johnson G (ne), Kevin B (ne), Korpan J (ne), Maree B (ne), MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

Mtshisi B (ne), Weisman R (ne), Johnson C (CEO & President) Citicorp Nominees (Pty) Ltd. 23.11%

POSTAL ADDRESS: PO Box 49143, Vancouver, BC, Canada, V7X 1J1 HSBC Custody Nominees (Australia) Ltd. 17.09%

MORE INFO: www.sharedata.co.za/sdo/jse/B2G JP Morgan Nominees Australia (Pty) Ltd. 8.00%

COMPANY SECRETARY: Roger Richer POSTAL ADDRESS: PO Box 1973, Subiaco Western Australia, 6904

AUDITORS: PwC LLP MORE INFO: www.sharedata.co.za/sdo/jse/BMN

CAPITAL STRUCTURE AUTHORISED ISSUED COMPANY SECRETARY: Steve Herlihy

B2G Cmn shrs no par val - 1 063 053 499 AUDITORS: Ernst & Young

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [USDc] BMN Ord shrs no par va - 178 784 496

Cmn shrs no par val Ldt Pay Amt

Quarterly No 16 29 Nov 24 12 Dec 24 4.00 LIQUIDITY: Apr25 Avg 3 794 shares p.w., R206 976.2(0.1% p.a.)

Quarterly No 15 9 Sep 24 23 Sep 24 4.00 40 Week MA BANNERMAN

LIQUIDITY: Apr25 Avg 379 shares p.w., R19 898.4(-% p.a.) 5540

40 Week MA B2GOLD

4468

12740

3396

11053

2324

9365

1252

7678

180

5990 2020 | 2021 | 2022 | 2023 | 2024 |

NOTES: Bannerman Energy Ltd. underwent a 10:1 share consolidation on

4303 18 July 2022, historical figures have been adjusted.

2020 | 2021 | 2022 | 2023 | 2024 |

Bannerman Resources Ltd. renamed to Bannerman Energy Ltd. on 29 July

FINANCIAL STATISTICS 2021.

(Amts in USD’000) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

Final Final Final Final Final FINANCIAL STATISTICS

Dec 24

Wrk Revenue 1 902 030 1 934 272 1 732 590 1 762 264 1 788 928 (Amts in AUD’000) Interim Jun 24 Jun 23 Jun 22 Jun 21

Final

Final

Final

Final

Wrk Pft 706 195 780 001 604 244 768 552 958 287 Op Inc - 1 143 - 5 744 - 6 081 - 3 481 - 2 277

NetIntPd(Rcd) 14 114 - 4 594 - 1 122 11 798 15 803

Minority Int 3 238 31 491 33 850 40 760 44 350 NetIntPd(Rcvd) - 45 - - 1 590 - 1 379 - 30 - - 23 -

- 47

Minority Int

- 110

Att Inc - 629 891 10 097 252 873 420 065 628 063 Att Inc - 2 658 - 9 515 - 4 640 - 3 451 - 2 254

TotCompIncLoss - 604 168 62 201 277 153 463 059 628 063 TotCompIncLoss 900 - 7 945 - 10 363 - 5 931 2 654

Ord SH Int 2 983 065 3 810 379 3 008 126 2 860 294 2 572 016 Fixed Ass 13 270 92 69 62 65

LT Liab 1 027 876 463 067 153 313 181 210 194 793

2 629

3 782

9 199

Cap Employed 4 233 311 4 561 148 3 447 617 3 330 104 3 076 286 Inv & Loans 84 014 25 003 43 366 59 414 - 12 517 -

Tot Curr Ass

Mining Ass 3 291 435 3 563 490 2 274 730 2 231 831 2 387 020 Ord SH Int 189 944 106 701 111 091 117 947 66 406

Inv & Loans 76 717 86 007 31 865 - - Minority Int - 2 169 - 990 - 387 - 57 - 47

Tot Curr Ass 901 789 710 729 1 035 171 1 033 417 762 698 LT Liab 739 692 317 298 295

Tot Curr Liab 580 687 313 471 233 616 231 189 286 093

Tot Curr Liab 3 918 1 386 1 935 1 653 304

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

DPS (ZARc) 293.28 305.96 262.75 113.36 61.12 NAV PS (ZARc) 1 376.96 850.29 926.32 891.11 601.50

NAV (ZARc) 4 275.37 5 354.03 4 764.07 4 329.15 3 601.51 3 Yr Beta 0.24 - 0.05 0.82 1.13 1.60

3 Yr Beta 0.33 0.29 0.53 0.42 0.44 Price High 4 174 5 769 2 756 3 490 386 820

Price Prd End 4 544 5 878 6 087 6 199 8 342 Price Low 2 314 1 775 211 211 350

Price High 6 071 8 050 7 308 9 022 12 740 Price Prd End 3 385 3 999 2 052 2 120 1 720

Price Low - 5 371 5 084 5 018 71

RATIOS

RATIOS Ret on SH Fnd - 2.88 - 9.05 - 4.29 - 2.95 - 3.43

Ret on SH fund - 20.64 1.06 9.21 15.56 25.27 D:E - 0.01 - - -

Ret on Tot Ass 14.43 16.50 16.72 21.25 28.03

Current Ratio 21.44 18.04 22.41 35.94 41.17

21