Page 161 - Profile's Stock Exchange Handbook -2024 Issue 4

P. 161

Profile’s Stock Exchange Handbook: 2024 – Issue 4 JSE – OCE

Oceana Group Ltd. Octodec Investments Ltd.

OCE OCT

ISIN: ZAE000025284 ISIN: ZAE000192258

SHORT: OCEANA SHORT: OCTODEC

CODE: OCE CODE: OCT

REG NO: 1939/001730/06 REG NO: 1956/002868/06

FOUNDED: 1918 FOUNDED: 1956

LISTED: 1947 LISTED: 1990

NATURE OF BUSINESS: The Oceana Group is a global fishing and food NATURE OF BUSINESS: Octodec Investments Ltd. (Octodec or the

processing company with a strong, experienced management team, and company), its subsidiaries and associated company (the group) is a real

businesses that operate across the full value-chain which includes catching estate investment trust (REIT) listed on the JSE Ltd. (JSE) with a

or procuring, processing, distributing, and selling. It is Africa’s largest diversified portfolio of 237 residential, retail, office and industrial

fishing company with a history dating back over 105 years. The Group properties situated in the major metropolitan areas of Tshwane and

operates 54 vessels and 8 production facilities across three countries on two Johannesburg. The portfolio, including an equity-accounted joint venture,

continents, selling products to customers in 41 countries. has a lettable area of 1 525 486m 2 and is valued at R11.2 billion.

SECTOR: ConsStaples—Food,Beverage&Tobacco—Food Producers—Farmers SECTOR: RealEstate—RealEstate—REITS—Retail

NUMBER OF EMPLOYEES: 3 416 NUMBER OF EMPLOYEES: 191

DIRECTORS: de BeyerPG(ld ind ne), GolesworthyPJ(ind ne), DIRECTORS: Buchholz R (ind ne), CohenDP(ld ind ne),

Jakoet A (ind ne), Mokgosi-Mwantembe T (ind ne), PangarkerNA(ne), MabundaNC(ind ne), MojapeloEMS(ind ne), PollackMZ(ne),

SenneloLJ(ind ne), SimamaneNV(ind ne), Viranna P (ind ne), StrydomPJ(ind ne), Van BredaLP(ind ne), Wapnick J P (MD),

Brey M A (Chair, ne), Brink N (CEO), Mahomed Z (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 05 Sep 2024 Vieira A (FD), Wapnick S (Chair, ne)

Newshelf 1063 (RF) (Pty) Ltd. 25.10% MAJOR ORDINARY SHAREHOLDERS as at 25 Jun 2024

Public Investment Corporation (SOC) Ltd. 21.40% Lefkopaul CC 7.59%

M&G Investment Managers (Pty) Ltd. 9.14% Tomnef Investments (Pty) Ltd. 6.89%

POSTAL ADDRESS: PO Box 7206, Roggebaai, 8012 Old Mutual Group 4.19%

EMAIL: jayesh.jaga@oceana.co.za POSTAL ADDRESS: PO Box 15, Tshwane, 0001

WEBSITE: www.oceana.co.za EMAIL: info@octodec.co.za

TELEPHONE: 021-410-1400 FAX: 021-419-5979 WEBSITE: www.octodec.co.za

COMPANY SECRETARY: Jayesh Jaga TELEPHONE: 012-319-8781

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. GROUP COMPANY SECRETARY: Elize Greeff

SPONSOR: Standard Bank of South Africa Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Mazars SPONSOR: Java Capital

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: Ernst & Young Inc.

OCE Ords no par val. 300 000 000 130 431 804 CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] OCT Ords no par 500 000 000 266 197 535

Ords no par val. Ldt Pay Amt DISTRIBUTIONS [ZARc]

Interim No 160 25 Jun 24 1 Jul 24 195.00 Ords no par Ldt Pay Amt

Final No 159 19 Dec 23 27 Dec 23 305.00 Interim No 65 4Jun 24 10 Jun 24 60.00

LIQUIDITY: Sep24 Avg 651 721 shares p.w., R46.3m(26.0% p.a.) Final No 65 21 Nov 23 27 Nov 23 75.00

LIQUIDITY: Sep24 Avg 860 294 shares p.w., R8.5m(16.8% p.a.)

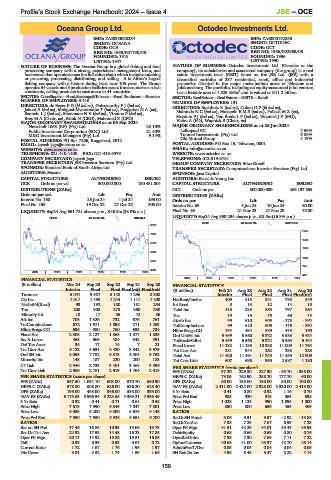

FOOD 40 Week MA OCEANA

REIV 40 Week MA OCTODEC

8072

2053

7386

1733

6700

1414

6014

1094

5328

775

4641

2019 | 2020 | 2021 | 2022 | 2023 | 2024

455

FINANCIAL STATISTICS 2019 | 2020 | 2021 | 2022 | 2023 | 2024

(R million) Mar 24 Sep 23 Sep 22 Sep 21 Sep 20 FINANCIAL STATISTICS

Interim Final Final Final(rst) Final(rst) (R million) Feb 24 Aug 23 Aug 22 Aug 21 Aug 20

Turnover 5 041 9 987 8 148 7 296 8 308 Interim Final Final Final Final(rst)

Op Inc 1 017 1 490 1 244 1 117 1 400 NetRent/InvInc 409 813 841 783 849

NetIntPd(Rcvd) 93 192 180 181 254 Int Recd 8 13 12 14 15

Tax 208 308 273 260 330 Total Inc 418 838 853 797 864

Minority Int 10 17 36 42 56 Tax 10 19 16 60 13

Att Inc 706 1 326 732 676 761 Attrib Inc 99 610 605 - 175 - 892

TotCompIncLoss 672 1 571 1 895 211 1 253 TotCompIncLoss 99 610 605 - 175 - 892

Hline Erngs-CO 696 980 760 635 734 Hline Erngs-CO 194 434 689 473 160

Fixed Ass 2 308 2 127 1 865 1 877 1 835 Ord UntHs Int 6 459 6 560 6 322 5 983 6 424

Inv & Loans 465 505 484 342 391 TotStockHldInt 6 459 6 560 6 322 5 983 6 424

Def Tax Asset 34 17 14 7 21 Fixed Invest 11 132 11 135 10 938 11 009 11 764

Tot Curr Ass 5 122 4 634 4 420 3 342 3 979 Tot Curr Ass 281 344 262 298 223

Ord SH Int 8 055 7 782 6 813 5 304 5 763 Total Ass 11 420 11 491 11 245 11 455 12 009

Minority Int 148 187 220 200 183 Tot Curr Liab 607 696 955 2 587 1 180

LT Liab 2 946 2 733 3 461 3 464 3 896 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 2 986 2 781 2 519 1 704 2 018

EPS (ZARc) 37.20 229.30 227.30 - 65.70 - 335.00

PER SHARE STATISTICS (cents per share) HEPS-C (ZARc) 73.05 162.90 258.70 177.70 60.00

EPS (ZARc) 587.60 1 094.10 603.00 570.70 650.90 DPS (ZARc) 60.00 135.00 130.00 50.00 100.00

HEPS-C (ZARc) 578.80 808.80 626.00 536.20 628.40 NAV PS (ZARc) 2 411.00 2 424.00 2 328.00 2 320.00 2 413.00

DPS (ZARc) 195.00 435.00 346.00 358.00 393.00 3 Yr Beta 0.41 0.80 0.92 1.16 0.70

NAV PS (ZARc) 6 175.63 5 966.34 5 223.65 4 369.21 4 936.49 Price Prd End 985 920 919 863 598

3 Yr Beta 0.32 0.41 0.71 0.64 0.55 Price High 1 028 1 125 990 1 095 1 800

Price High 7 619 7 990 6 849 7 847 7 501 Price Low 850 800 656 455 469

Price Low 6 053 5 200 4 300 5 674 4 148 RATIOS

Price Prd End 7 050 7 550 5 326 6 654 6 200 RetOnSH Funds 3.06 9.31 9.57 - 2.92 - 13.88

RATIOS RetOnTotAss 7.38 7.29 7.67 6.99 7.23

Ret on SH Fnd 17.46 16.85 10.93 13.06 13.73 Oper Pft Mgn 41.51 42.29 44.01 43.47 45.95

Ret On Tot Ass 22.92 17.53 14.48 16.23 17.85 Debt:Equity 0.68 0.66 0.69 0.80 0.76

Oper Pft Mgn 20.17 14.92 15.26 15.31 16.85 OperRetOnInv 7.35 7.30 7.69 7.11 7.22

D:E 0.39 0.39 0.53 0.67 0.72 OpInc:Turnover 40.68 41.00 43.37 42.70 45.14

Current Ratio 1.72 1.67 1.76 1.96 1.97 AdminFee:T/Ovr 0.05 0.05 0.04 0.04 0.05

Div Cover 3.01 2.52 1.74 1.59 1.66 SH Ret On Inv 4.95 5.48 5.47 2.22 4.14

159