Page 7 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 7

Profile’s Stock Exchange Handbook: 2025 - Issue 3 About the Stock Exchange Handbook

The Sector Table includes the JSE code, year end, The various databases from which the Stock

next results, market cap, P/E, market beta, volatility Exchange Handbook is compiled are updated on

and rand value traded per week. A sector total is virtually a real-time basis. Our ShareData system, from

provided for market cap, and averages for P/E and which the handbook’s financial statistics are drawn,

market beta. is updated on a daily basis, and we receive earnings

The Corporate Events Table provides a summary estimates from stockbroking firms on a weekly basis.

of new listings, delistings, name changes, sector The Stock Exchange Handbook represents a ‘snapshot’

changes, splits, and consolidations that took place of these highly up-to-date databases as close to the

between issues of the Stock Exchange Handbook. print deadline as possible.

Readers can access up-to-date information at www.

Compilation of the Stock sharedata.co.za.

Exchange Handbook Sources of Information

Publication Cycle ProfileData, which incorporates the research

division of the Profile Group, is a primary data

The Stock Exchange Handbook is published in source, and most of our information is researched

February, May, August and November each year. independently and drawn directly from each

Reporting of results by JSE listed companies is company’s own reports and accounts. SENS notices,

currently concentrated in three distinct periods – published financials and other announcements are

March-May, August-September, and November. processed on a real-time basis.

The publication of four books per year enhances the

inclusion of recently published results even further.

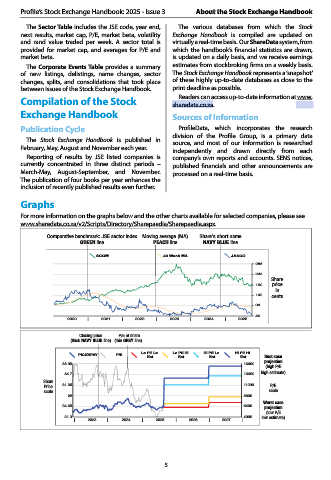

Graphs

For more information on the graphs below and the other charts available for selected companies, please see

www.sharedata.co.za/v2/Scripts/Directory/Sharepaedia/Sharepaedia.aspx.

Comparative benchmark: JSE sector index Moving average (MA) Share’s short name

GREEN line PEACH line NAVY BLUE line

SCOM 40 Week MA JASCO

286

238

Share

190 price

in

142 cents

94

46

2020 | 2021 | 2022 | 2023 | 2024 | 2025

Closing price P/E of share

(thick NAVY BLUE line) (thin GREY line)

PICKNPAY P/E Lo PE Lo Lo PE Hi Hi PE Lo Hi PE Hi

Est Est Est Est Best case

38.05 16000 projection

(high P/E

high estimate)

34.7 13600

Share

Price 31.35 11200 P/E

scale scale

28 8800

Worst case

24.65 6400 projection

(low P/E

21.3 4000 low estimate)

| 2023 | 2024 | 2025 | 2026 | 2027 |

5