Page 29 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 29

Profile’s Stock Exchange Handbook: 2025 - Issue 3 NSX - NAM

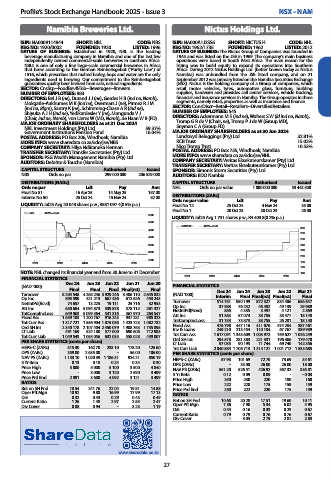

Namibia Breweries Ltd. Nictus Holdings Ltd.

ISIN: NA0009114944 SHORT: NBL CODE: NBS ISIN: NA000A1J2SS6 SHORT: NICTUS H CODE: NHL

REG NO: 1920/0002 FOUNDED: 1920 LISTED: 1996 REG NO: 1962/1735 FOUNDED: 1962 LISTED: 2012

NATURE OF BUSINESS: Established in 1920, NBL is the leading NATURE OF BUSINESS: The Nictus Group of Companies was founded in

beverage manufacturing company in Namibia and one of the last few 1945 and was listed on the JSE in 1969. The company’s main business

independently owned commercial-scale breweries in southern Africa. operations were based in South West Africa. The main reason for the

NBL’s is one of only a few large-scale commercial breweries in Africa listing was to build equity to expand its operations into Southern

that brew according to the German Reinheitsgebot (“Purity Law”) of Africa. During 2012 Nictus Holdings Ltd. (better known today as Nictus

1516, which prescribes that malted barley, hops and water are the only Namibia) was unbundled from the JSE listed company, and on 21

ingredients used in brewing. Our commitment to the Reinheitsgebot September 2012 was primary listed on the Namibia Securities Exchange

guarantees quality beer brewed from safe, natural ingredients. (NSX). Nictus is the holding company of a Group of companies, which

SECTOR: CnsStp--FoodBev&Tob--Beverages--Brewers retail motor vehicles, tyres, automotive glass, furniture, building

NUMBER OF EMPLOYEES: 983 supplies, hardware and provides call center services, vehicle tracking,

DIRECTORS: Bel J B (ne), Durand J J (ne), Gerdes H B (ind ne, Namb), financial and insurance services in Namibia. The Group operates in three

Mokgatle-Aukhumes M K (ind ne), Overmars J (ne), Pirmez R J M segments, namely retail, properties as well as insurance and finance.

(ind ne, Blgm), Santry K (ne), Schimming-Chase A R (ind ne), SECTOR: ConsDiscr--Retail--Retailers--DiversifiedRetailers

Shiyuka A J H (ind ne), Yedikardesler Y (ne), Mungunda V J NUMBER OF EMPLOYEES: 545

(Chair, ind ne, Namb), von Lieres W (MD, Namb), de Haan W B (FD) DIRECTORS: Ackermann M E (ind ne), Walters S W (ld ind ne, Namb),

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024 Tromp G R de V (Chair, ne), Tromp P J de W (Group MD),

NBL Investment Holdings (Pty) Ltd. 59.37% Snyman C A (Group FD)

Government Institutions Pension Fund 16.04% MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

POSTAL ADDRESS: PO Box 206, Windhoek, Namibia Landswyd Beleggings (Pty) Ltd. 32.81%

MORE INFO: www.sharedata.co.za/sdo/jse/NBS KCB Trust 15.02%

COMPANY SECRETARY: Hilya Ndiitaneka Herman Nico Tromp Trust 10.53%

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. POSTAL ADDRESS: PO Box 755, Windhoek, Namibia

SPONSOR: PSG Wealth Management Namibia (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/NHL

AUDITORS: Deloitte & Touche (Namibia) COMPANY SECRETARY: Veritas Eksekuteurskamer (Pty) Ltd.

CAPITAL STRUCTURE Authorised Issued TRANSFER SECRETARY: Veritas Eksekuteurskamer (Pty) Ltd.

SPONSOR: Simonis Storm Securities (Pty) Ltd.

NBS Ords no par 299 000 000 206 529 000 AUDITORS: BDO Nambia

DISTRIBUTIONS [NADc] CAPITAL STRUCTURE Authorised Issued

Ords no par Ldt Pay Amt NHL Ords no par value 1 000 000 000 53 443 500

Final No 51 16 Apr 25 14 May 25 157.00

Interim No 50 25 Oct 24 15 Nov 24 52.00 DISTRIBUTIONS [ZARc]

Ldt

Amt

Pay

LIQUIDITY: Jul25 Avg 20 043 shares p.w., R581 097.4(0.5% p.a.) Ords no par value 25 Oct 24 4 Nov 24 35.00

Final No 12

Final No 1 20 Oct 23 30 Oct 23 26.00

NBL 40 Week MA

5500

LIQUIDITY: Jul25 Avg 1 731 shares p.w., R4 403.8(0.2% p.a.)

5000

NICTUS H 40 Week MA

4500 300

280

4000

260

3500 240

220

3000

200

2500

2021 2022 2023 2024 2025 180

160

NOTE: NBL changed its financial year end from 30 June to 31 December. 140

FINANCIAL STATISTICS 2021 2022 2023 2024 2025

Dec 24 Jun 23 Jun 22 Jun 21 Jun 20

(NAD ’000) FINANCIAL STATISTICS

Final Final Final Final(rst) Final Dec 24 Jun 24 Jun 23 Jun 22 Mar 21

Turnover 8 204 548 4 265 246 3 929 246 3 406 110 2 645 832 (NAD ’000)

Op Inc 895 590 421 213 667 436 612 626 453 243 Interim Final Final(rst) Final(rst) Final

NetIntPd(Rcvd) 74 657 13 225 19 111 25 716 32 953 Turnover 514 751 950 199 872 327 834 406 656 647

Att Inc 650 684 5 094 873 539 878 378 112 261 327 Op Inc 37 988 76 252 46 482 49 139 29 989

TotCompIncLoss 649 963 5 099 364 541 316 367 970 263 547 NetIntPd(Rcvd) 856 4 335 3 497 4 121 2 369

Fixed Ass 1 639 103 1 200 767 916 243 937 281 985 323 Att Inc 31 363 57 073 38 755 38 477 18 148

Tot Curr Ass 1 317 721 1 556 904 1 875 036 1 423 723 1 082 732 TotCompIncLoss 31 753 73 873 38 755 26 281 18 148

Ord SH Int 2 340 178 2 107 404 2 450 079 1 908 763 1 755 895 Fixed Ass 476 798 447 116 411 676 374 284 387 461

LT Liab 491 169 524 180 577 000 690 606 712 983 Inv & Loans 249 210 213 454 110 184 67 767 389 939

Tot Curr Liab 1 049 543 1 055 056 632 033 558 028 439 007 Tot Curr Ass 1 617 091 1 343 609 1 003 972 759 627 1 026 249

PER SHARE STATISTICS (cents per share) Ord SH Int 294 578 281 383 221 331 196 306 179 470

97 035

142 356

LT Liab

71 744

90 195

69 740

HEPS-C (ZARc) 315.30 162.70 233.10 178.20 125.60 Tot Curr Liab 2 040 584 1 706 713 1 314 127 1 001 712 1 533 685

DPS (ZARc) 359.00 2 635.00 - 56.00 106.00 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 1 133.10 1 020.39 1 186.31 924.21 850.19 HEPS-C (ZARc) 57.93 101.69 72.70 73.69 34.61

3 Yr Beta 0.13 0.18 0.24 0.34 0.30

Price High 3 800 5 000 5 100 3 500 4 840 DPS (ZARc) - 35.00 26.00 26.00 18.00

Price Low - 3 000 3 120 2 590 3 499 NAV PS (ZARc) 551.20 526.51 426.92 367.32 335.81

Price Prd End 2 891 3 680 4 092 3 121 3 499 3 Yr Beta 0.12 0.09 0.09 180 - - 0.03

230

220

160

Price High

250

RATIOS Price Low 222 220 175 159 159

Ret on SH Fnd 18.54 241.76 22.04 19.81 14.88 Price Prd End 250 222 220 175 159

Oper Pft Mgn 10.92 9.88 16.99 17.99 17.13

D:E 0.32 0.43 0.29 0.43 0.49 RATIOS

Current Ratio 1.26 1.48 2.97 2.55 2.47 Ret on SH Fnd 10.65 20.28 17.51 19.60 10.11

Div Cover 0.88 0.94 - 3.23 1.19 Oper Pft Mgn 7.36 7.90 5.34 6.02 4.95

D:E 0.44 0.16 0.33 0.23 0.67

Current Ratio 0.79 0.79 0.76 0.76 0.67

Div Cover - 3.05 2.79 2.82 2.83

www.sharedata.co.za

27