Page 44 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 44

CTSE – 4AARB Profile’s Stock Exchange Handbook: 2025 – Issue 1

Arbitrage Holdings Ltd. BKB Ltd.

4AARB 4ABKB

ISIN: ZAE400000267 SHORT: ARBITRAGE CODE: 4AARB ISIN: ZAE400000069 SHORT: BKB CODE: 4ABKB

REG NO: 24/ 2021/732583/06 FOUNDED: 2021 LISTED: 2024 REG NO: 1998/012435/06 FOUNDED: 1998 LISTED: 2022

NATURE OF BUSINESS: Arbitrage Holdings is dedicated to shaping the NATURE OF BUSINESS: BKB was established in 1998 as the ultimate

future of energy. As a premier energy and mining company, Arbitrage holding Company of the BKB Group of Companies, which is a leading

Holdings manages a diverse portfolio encompassing both traditional coal player in the South African agricultural industry. The BKB Group operates

assets and pioneering renewable energy projects directly in multiple agricultural sectors across all 9 (nine) provinces in

SECTOR: Energy—Energy—OilGas&Coal—Coal South Africa as well as in eSwatini and the Kingdom of Lesotho.

NUMBER OF EMPLOYEES: 0 SECTOR:ConsStaples—Food,Beverage&Tobacco—FoodProducers—Farmers

DIRECTORS: NtseareTM(ind ne), Rautenbach I (ld ind ne), NUMBER OF EMPLOYEES: 0

Seoloane K (ind ne), Tlale C K, Kotze C (Chair, ind ne), Swart R (CEO), DIRECTORS: du Toit A S, Fick C (ind ne), HobsonCD(ind ne),

de Jager P C (CFO) Janse Van RensburgJF(ind ne), LouwJG(ind ne), StapleHC(ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 09 Dec 2024 ZondiTP(ind ne), Stumpf J E (MD), van Niekerk J A (CFO)

NIO Capital 27.50% MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

Afri Goal 27.12% VKB Beleggings (Pty) Ltd. 30.25%

AT CMS 9.23% BKB Beperk Personeel Aandeletrust 11.60%

POSTAL ADDRESS: 40 Oxford Street, Durbanville, 7550 The BKB Empowerment Trust (Ciskei) 5.50%

MORE INFO: www.sharedata.co.za/sdo/jse/4AARB POSTAL ADDRESS: PO Box 2002, North End, Gqeberha, 6056

COMPANY SECRETARY: Poloko Dikgole MORE INFO: www.sharedata.co.za/sdo/jse/4ABKB

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd. COMPANY SECRETARY: Johannette Oosthuizen

AUDITORS: Louis Jonker Chartered Accountants TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

4AARB Ords no par value 1 000 000 000 696 934 809 CAPITAL STRUCTURE AUTHORISED ISSUED

4ABKB Ords no par value 200 000 000 88 407 075

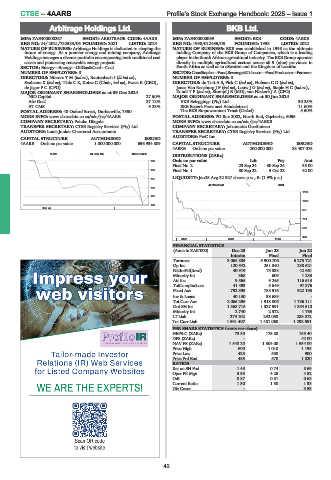

ALSH 40 Day MA ARBITRAGE

DISTRIBUTIONS [ZARc]

158 Ords no par value Ldt Pay Amt

Final No 2 23 Sep 24 30 Sep 24 33.00

156

Final No 1 30 Sep 22 3 Oct 22 42.00

155 LIQUIDITY: Jan25 Avg 32 927 shares p.w., R-(1.9% p.a.)

40 Week MA BKB

153

1185

152

1028

150

Dec 24 |

871

714

557

400

| 2022 | 2023 | 2024 |

FINANCIAL STATISTICS

(Amts in ZAR’000) Dec 23 Jun 23 Jun 22

Interim Final Final

Turnover 3 068 839 5 900 706 5 275 721

Op Inc 120 542 251 340 238 621

NetIntPd(Rcvd) 40 919 75 338 42 661

Minority Int 368 609 1 233

Att Inc 9 566 9 245 116 613

TotCompIncLoss 41 493 5 649 97 376

Fixed Ass 792 395 785 516 922 193

Inv & Loans 40 130 38 689 -

Tot Curr Ass 2 066 296 1 918 006 1 786 111

Ord SH Int 1 368 716 1 327 591 1 354 510

Minority Int 2 740 2 372 1 763

LT Liab 279 102 292 058 288 872

Tot Curr Liab 1 591 407 1 481 060 1 292 691

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 73.80 175.80 158.40

DPS (ZARc) - - 42.00

NAV PS (ZARc) 1 548.20 1 504.00 1 534.00

Price High 600 1 010 1 195

Price Low 425 550 900

Price Prd End 435 570 1 020

RATIOS

Ret on SH Fnd 1.45 0.74 8.69

Oper Pft Mgn 3.93 4.26 4.52

D:E 0.87 0.81 0.68

Current Ratio 1.30 1.30 1.38

Div Cover - - 3.53

42